Is China Still Concerned about Capital Outflows?

We continue to believe that when evaluating any investment in either the emerging markets or any global allocation of assets, China needs to be considered.

Oct. 10 2016, Updated 12:04 p.m. ET

Concern over capital outflows abates

We continue to believe that when evaluating any investment in either the emerging markets or any global allocation of assets, China needs to be considered. Although current concern surrounding China’s capital outflows may have decreased, there continues to be net depreciation pressure on the Renminbi. However, in some ways, mild, engineered depreciation versus a basket of currencies, while keeping a lid on capital outflow pressures, may represent a positive outcome for China.

Market Realist – Is the Chinese renminbi stabilizing?

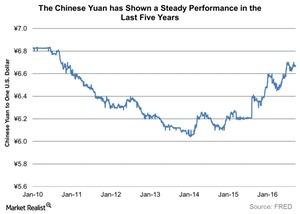

As we discussed in Part 1, China’s (FXI)(CNXT) economic events affect the world economy (ACWI). As you can see in the chart above, the Chinese renminbi, also known as the yuan, has been stabilizing since its devaluation a year ago. A slight tweak to the country’s currency policy made the yuan plummet. The yuan devaluation affected the Asian (AIA) and global markets (FCO) as speculation about a distinct slowdown in the Chinese economy increased.

In August, Adrian Mowat, chief Asian and emerging market equity strategist at J.P. Morgan, said in an interview on CNBC’s Squawk Box, “Now, I think we’ve got much more mature currency markets, and the market recognizes the fact that Renminbi, like every other currency, should move up and down and we shouldn’t be overly dramatic about the impact of it.” He added that he expected a further 1% to 2% decline this year after the currency’s ~7% fall last year.

Although the renminbi is strengthening against the US dollar, it continues to slip against a basket of major currencies. Along with the currency devaluation, the country also introduced a new exchange rate index that values the renminbi against a basket of 13 other currencies. Compared to this basket of currencies called the CFETS (China Foreign Exchange Trading System) RMB, the yuan seems to have been weakest in April 2016. The graph above from ANZ shows the recent performance of the yuan against both the US dollar and CFETS RMB basket of currencies.

Market Realist – Have capital outflows concern abated?

China’s intent to introduce this index was to measure its currency’s value against a broader range of currencies, letting the renminbi gradually fall against the dollar without causing any market concern. This approach, however, led to further capital outflows. As per data from the Institute of International Finance, China had almost $700 billion in capital outflows in 2015, led by the stock market crash and currency devaluation.

However, recent figures from Reuters showed that the pace of capital outflows is slowing. In August, net foreign exchange sales fell 70% to $9.5 billion compared to July. This fall depicts more balanced capital flows in the long term.

Let’s move on to discuss if China’s debt burden is a concern for investors in the next part of this series.