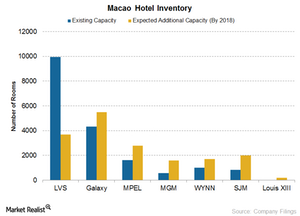

Hotel Inventory Is Rising, but Is There Enough Demand?

Macao casinos’ $28-billion investment in integrated resorts will change the city’s gaming. Capacity additions should increase the number of slot tables too.

Sept. 15 2016, Updated 8:04 a.m. ET

Slots increase

Macao casinos’ $28-billion investment in integrated resorts is poised to change the city’s gaming business. Meanwhile, capacity additions (as we discussed previously in this series) should significantly increase the number of slot tables.

Three new resorts set to open in 2016—Las Vegas Sands’ (LVS) Parisian Macao, MGM Resorts’ MGM Cotai, and Wynn Resorts’ Wynn Palace (WYNN)—are expected to be allotted 250 new gaming tables apiece, which is similar to the number of tables granted to Melco Crown (MPEL) and Galaxy in 2015. Notably, the Vanguard Extended Market ETF (VXF) holds 0.45% in LVS.

These new tables would lead to a 12% growth. Growth in slot tables coupled with declining visitors will be a major concern for Macao casinos.

Occupancy rises

The new resorts will almost double the number of hotel rooms in the strip. The absence of VIPs has also freed up a lot of rooms.

Increasing hotel inventory makes sense only when resorts can fill these rooms. For the first seven months of 2016, the hotel occupancy rate stood at 79.8%—a 0.5 percentage-point year-over-year improvement.

However, it’s still too soon to call it a recovery, particularly while the average length of stay continues to decline.

Declines in room rates

Increased supply has led to low room rates. According to Wells Fargo, room rates have declined by 18% as compared to 2015.

Clearly, Macao needs to see a significant increase in visitors. However, Union Gaming Research thinks that the Macao government will not allow unlimited growth in visitations.

Now let’s discuss the role of the Chinese economy in the Macao casino industry.