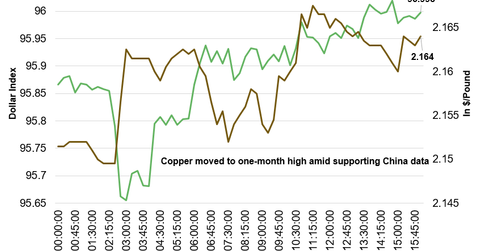

Copper Rose to 1-Month High Price Levels on September 20

At 1:15 PM EST on September 20, the COMEX copper futures contract for December delivery rose ~0.35%. It was trading at $2.16 per pound.

Dec. 4 2020, Updated 10:53 a.m. ET

Copper reached one-month high price levels

Copper started the day on a stable note and gained strength as the day progressed. At 1:15 PM EST on September 20, the COMEX copper futures contract for December delivery rose ~0.35%. It was trading at $2.16 per pound—a one-month high price level.

Chinese economic data support the prices

The sentiment in copper has been better since last week due to the release of better-than-expected Chinese economic data. Last week, China’s major economic releases such as industrial production data, fixed-asset investment data, retail sales, and new loans data were released. The data were better than the market’s expectations. The upbeat data strengthened the demand signals and improved the sentiment in the copper market. The strengthening of the property market in China also helped the sentiment. China is the largest copper consumer in the world. Industrial production and real estate trends in China will influence copper’s price and demand trends.

China’s copper output rose in August

According to the data released by National Bureau of Statistics at the beginning of this week on September 19, China’s copper output rose to almost a six-month high in August. According to the data, the copper output rose to 743,000 metric tons in August—higher than July’s output of 722,000 metric tons and output of 663,000 metric tons in August last year. The market is looking forward to the outcome of the Fed’s meeting and the Fed’s official statement.

At 1:30 PM EST on September 20, major copper producers Freeport-McMoRan (FCX) fell ~1.4%, while Glencore (GLNCY), BHP Billiton (BHP), and Rio Tinto (RIO) rose ~0.6%, ~1.5%, and ~0.1%, respectively. The SPDR S&P Metals & Mining ETF (XME) and the PowerShares DB Base Metals (DBB) rose ~0.04% and ~0.8%.