Coca-Cola Keeps Its Focus on Still Beverages for Future Growth

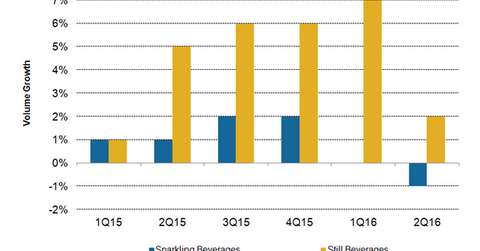

Coca-Cola’s (KO) still beverage volumes have seen higher growth compared to sparkling or soda beverages.

Sept. 14 2016, Updated 10:05 a.m. ET

Focus on growth in stills

Coca-Cola (KO) is focusing on capturing growth opportunities in the still beverage category, which includes ready-to-drink tea and packaged water. The company is rapidly expanding in the still beverage market to cater to the growing consumer needs beyond soda beverages.

During the Barclays Global Consumer Staples Conference held on September 6, James Quincey, Coca-Cola’s president and chief operating officer, noted that the company had a 15% value share of the global still beverage market in 2015 compared to a 50% value share of the global sparkling market.

Expanding still beverage portfolio

Coca-Cola’s (KO) still beverage volumes have seen higher growth compared to sparkling or soda beverages. In fiscal 2Q16, which ended on July 1, 2016, Coca-Cola’s still beverage volumes grew 2%. Its sparkling beverage volumes fell 1%.

The company’s rivals are also experiencing a similar trend. In 2Q16, PepsiCo’s (PEP) North America Beverages segment reported a 4% drop in its carbonated soft drink volumes and a 3% growth in its noncarbonated, or still beverage, volumes. Dr Pepper Snapple (DPS) reported a 1% rise in its 2Q16 soda volumes and a 2% rise in its noncarbonated beverage volumes.

Coca-Cola has made some attractive bolt-on acquisitions in the still beverage category. In June 2016, Coca-Cola acquired a minority stake in Aloe Gloe, an aloe water beverage. In June, Coca-Cola also announced the acquisition of AdeS soy-based beverage business from Unilever (UL).

Other acquisitions include a minority stake in Chi Limited—Nigeria’s leading dairy, juice, and snack company—as well as an ~30% stake in Suja Juice, a California-based manufacturer of organic juices. In June 2015, Coca-Cola acquired a 16.7% stake in leading energy drink maker Monster Beverage (MNST).

The iShares Global 100 ETF (IOO) has 1.8% exposure to Coca-Cola.

Innovation

Aside from strategic acquisitions, Coca-Cola is also internally developing new varieties of beverages. On June 15, 2016, Coca-Cola’s Honest Tea brand introduced Honest Sport at select Whole Foods Market (WFM) locations. Honest Sport is a new line of organic sports drinks sweetened with organic, fair trade–certified sugar and fruit juice.

On September 1, 2016, Coca-Cola’s Gold Peak brand announced that it will launch ready-to-drink tea lattes and coffees in 1Q17. Gold Peak is a popular brand iced tea brand. It crossed the $1 billion mark in annual sales for the first time in 2014.

In the next part of this series, we’ll discuss analysts’ expectations for Coca-Cola’s revenue in the current fiscal year.