How Has Hain Celestial’s Stock Fared ahead of Fiscal 4Q16 Results?

So far, Hain Celestial’s stock has shown tremendous growth of 31% in 2016, led by an exceptional performance each quarter. The stock has gained 16% since its last quarterly earnings release on May 4.

Aug. 12 2016, Updated 8:29 a.m. ET

Upcoming fiscal 4Q16 earnings

Hain Celestial Group (HAIN) is based in Lake Success, New York. The company is expected to report its fiscal 4Q16 results on August 16.

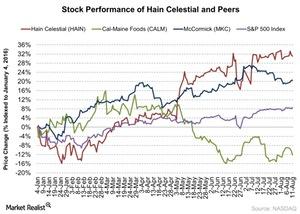

Hain Celestial’s stock performance

So far, Hain Celestial’s stock has shown tremendous growth of 31% in 2016, led by an exceptional performance each quarter. The stock has gained 16% since its last quarterly earnings release on May 4. The stock rose 9% after the company reported strong fiscal 3Q16 results. The third quarter showed 9% growth in earnings and a 13% rise in revenue year-over-year. The company also updated its guidance for fiscal 2016.

After the 3Q16 results, Jefferies raised its target price for HAIN from $50 to $55, consistent with its “buy” rating. The stock rose 4% to $46.50 on May 6. It fell as much as 30% in 2015. It outperformed the Market, represented by the S&P 500 Index, by 22% on August 11.

Peers’ stock performances

Hain Celestial is a part of the food industry. Along with its subsidiaries, it manufactures, markets, distributes, and sells organic and natural products. Its peers in the industry include Cal-Maine Foods (CALM), Kraft Heinz (KHC), and McCormick & Company (MKC).

So far in 2016, the peer companies have recorded the following returns:

- Cal-Maine Foods has fallen 12%.

- Kraft Heinz has risen 23%.

- McCormick has risen 20%.

Cal-Maine Foods, Kraft Heinz, and McCormick closed trade at $41.93 $89.40, and $101.59, respectively, on August 11. The First Trust NASDAQ-100 Ex-Technology Sector Index Fund (QQXT) and the First Trust NASDAQ-100 Equal Weighted Index Fund (QQEW) invest 1.4% and 0.94% of their respective portfolios in Kraft Heinz.

Series overview

In this pre-earning series, we’ll cover analysts’ revenue and earnings estimates and management’s guidance. We’ll also do a quick recap of how the company performed in its last reported quarter. Finally, we’ll look at how the company is advancing with its Project Terra and discuss Wall Street analysts’ recommendations over the next 12 months.

Let’s start with a recap of the company’s fiscal 3Q16 performance.