How 2Q16 Results Impacted Monster Beverage’s Valuation

As of August 5, Monster Beverage (MNST) was trading at a 12-month forward PE (price-to-earnings) ratio of 36.8x.

Aug. 11 2016, Updated 11:05 a.m. ET

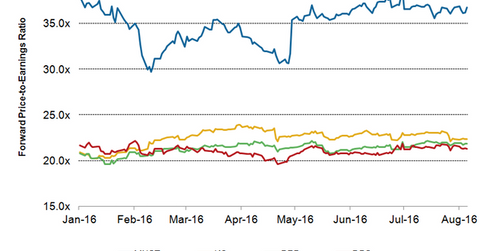

12-month forward PE

As of August 5, Monster Beverage (MNST) was trading at a 12-month forward PE (price-to-earnings) ratio of 36.8x. The company’s valuation multiple increased by 1.6% on August 5 in reaction to the company’s 2Q16 results announced after the close of financial markets on the previous day. As discussed in part one and two of this series, Monster Beverage posted strong earnings and sales growth in 2Q16. Monster Beverage is currently trading above its year-to-date average forward PE of 35.0x.

Valuation of peers

Monster Beverage’s valuation multiple is higher compared to its nonalcoholic beverage peers. As of August 5, Coca-Cola (KO), PepsiCo (PEP), and Dr Pepper Snapple (DPS) were trading at 12-month forward PEs of 22.3x, 21.9x, and 21.3x, respectively.

The company’s valuation multiple is also higher than the S&P 500 Consumer Staples Index with a forward PE of 20.9x and the S&P 500 Index with a forward PE of 17.5x. Monster Beverage’s higher valuation multiple is supported by the higher earnings growth expectations. For 2016, analysts expect Monster Beverage’s sales and adjusted EPS to rise by 12% and 31%, respectively. Currently, analysts expect the adjusted EPS of Coca-Cola, PepsiCo, and Dr Pepper Snapple to grow by -4%, 4%, and 9%, respectively, in 2016. Soda giants are under pressure due to softness in soda beverage volumes.

Growth prospects

Strong demand for Monster Beverage’s energy drinks in both domestic and international markets is expected to drive its top line in 2016. Also, the strategic deal with Coca-Cola has added some strong brands to Monster Beverage’s product portfolio. This deal will also help in strengthening Monster Beverage’s position in international markets in the long term given Coca-Cola’s strong global distribution network. Monster Beverage and Coca-Cola together constitute 5.4% of the iShares Global Consumer Staples ETF (KXI).

Monster Beverage is also focused on innovation of new products. The company is geared up for the launch of its Mutant refreshment energizer drink in September 2016. In the 2Q16 conference call, Rodney Sacks, Monster Beverage’s chair and CEO, stated that the company has additional new products slated for production later this year. The company is also working on other new products, which it plans to launch in early 2017.

We’ll discuss analyst recommendations for Monster Beverage’s stock in the concluding part of this series.