PepsiCo’s 2Q16 Earnings Rise on Improved Margins

Leading snack and beverage maker PepsiCo (PEP) delivered adjusted EPS (earnings per share) of $1.35 in 2Q16 ended June 11, 2016.

July 11 2016, Updated 5:25 p.m. ET

2Q16 earnings beat estimates

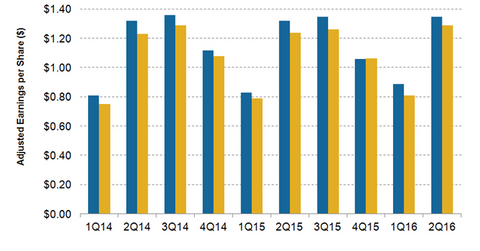

Leading snack and beverage maker PepsiCo (PEP) delivered adjusted EPS (earnings per share) of $1.35 in 2Q16 ended June 11, 2016. The company exceeded analysts’ earnings estimate of $1.29. PepsiCo had exceeded Wall Street expectations in 1Q16 as well. The news of PepsiCo exceeding earnings expectations in 2Q16 and a rise in its fiscal 2016 adjusted EPS guidance sent PepsiCo’s stock price up by 1.5% on July 7.

Earnings rise in 2Q16

PepsiCo’s adjusted EPS increased by 2.3% in 2Q16, compared with a growth rate of 7.2% in 1Q16 and -0.2% in 2Q15. The growth in PepsiCo’s earnings in 2Q16 was driven by improved margins and the strong performance of the company’s North America business. We’ll discuss the company’s margins in part four of this series and its North America business in part three of this series.

In 2Q16, currency headwinds impacted PepsiCo’s EPS by 4%. Coca-Cola (KO) and PepsiCo have a strong international presence, which exposes them to significant currency fluctuations. In fiscal 2015, PepsiCo and Coca-Cola generated 44% and 54% of their revenues, respectively, from international operations. Smaller nonalcoholic beverage companies Dr Pepper Snapple (DPS) and Monster Beverage (MNST) generated 11.3% and 21.3%, respectively, of their fiscal 2015 net sales outside the United States.

Aside from currency headwinds, the deconsolidation of PepsiCo’s Venezuelan operations had a three-percentage-point impact on PepsiCo’s 2Q16 adjusted EPS. The iShares Global Consumer Staples ETF (KXI) has a 4.4% exposure to PepsiCo.

Fiscal 2016 EPS guidance raised

Based on the results in the first half of fiscal 2016, PepsiCo raised its fiscal 2016 EPS guidance to $4.71 from the company’s previous guidance of $4.66. PepsiCo delivered adjusted EPS of $4.57 in fiscal 2015.

In this series on PepsiCo’s 2Q16 results, we’ll discuss the company’s sales, segment performance, and margins. The series will also provide information on analyst recommendations for PepsiCo’s stock and valuation. We’ll start with a discussion on PepsiCo’s 2Q16 revenue in the next part of this series.