What’s Needed to Ensure Long-Term Economic Growth?

China is consistently propping up domestic demand backed by strong credit growth. The impacts of Chinese stimulus measures are starting to show results.

June 13 2016, Updated 3:04 p.m. ET

But the upturn in Chinese activity could prove more durable. Policymakers began adding stimulus to the economy 18 months ago, but it is only now that the effects are starting to show in the data. There is therefore another 18 months’ worth of stimulus ‘baked into the cake’ that may continue to boost the Chinese economy. Historically, cycles of Chinese economic activity around longer-term trends appear to last for just over a year on average – again lending support to the view that the upturn could continue for a while yet. Finally, the 19th National Congress of the Communist Party of China will be held in the autumn of 2017, when up to five new members of the seven-person Politburo Standing Committee could be appointed. President Xi Jinping may seek a set of appointments that aids his own consolidation of power, a goal that would presumably be easier in an economic upturn. This argues for the continued use of policy stimulus to ensure a favorable economic backdrop until then.

Market Realist – Continued use of stimulus measures needed for long-term economic growth

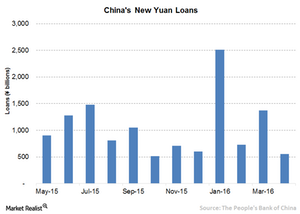

As part of the stimulus measures, China (FXI) (MCHI) is consistently propping up domestic demand backed by strong credit growth. In January, Chinese banks extended new loans worth $385 billion—the highest in nearly a year. The impacts of Chinese (GXC) (PGJ) stimulus measures are starting to show results after a certain lag.

The economy gathered pace in March. A rise in incremental credit led to a rebound in the property market. Similarly, an increase in industrial production, capital investment, and household spending bolstered economic activities in the country. The Minxin manufacturing index rose to 46.9 in April—the highest in a year. The non-manufacturing index increased to 44.2 from 40.1 in March. These are signs of an improving economic environment in the country. The recovery will likely persist in the second half of the year due to a lag effect from the earlier stimulus.

Political will

China’s government hopes that a more aggressive stimulus can be a panache for current economic issues. However, authorities also agree that given the large-scale imbalances in the Chinese (ASHR) system, a massive stimulus without structural reforms might not yield the required outcome in the long run. As a result, the government intends to consolidate the political base in the country. This will facilitate sustainable economic recovery.