Why Municipal Bonds Are Immune to Market Volatility

Generally, municipal bonds (SUB) are immune to market volatility, thus providing considerable support to a portfolio.

June 27 2016, Updated 1:04 a.m. ET

Other potential advantages to owning muni bonds include:

Low volatility

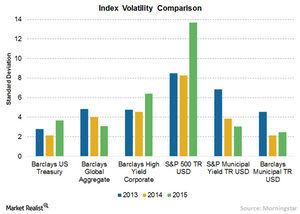

All fixed income assets have varying degrees of volatility, often driven by the interest rate backdrop and credit conditions. Munis (even the high yield variety) have been shown to experience lower volatility than other categories of bonds, including Treasuries and investment-grade corporates. They tend to be less affected by Fed rate uncertainty than Treasuries and have benefitted from firmer credit conditions at the low end of the quality spectrum (high yield). In 2015, 10-year cumulative default rates stood at 0.24% for municipals vs. 11.16% for corporate bonds, according to data from S&P.

Market Realist – Municipal bonds are immune to market volatility

Generally, municipal bonds (SUB) are immune to market volatility, thus providing considerable support to a portfolio. As you can see in the above graph, the Barclays Municipal Bond Index was less volatile in 2015 compared to all other indexes.

Better returns

During Market volatility, municipal bonds could provide higher returns compared to most other asset classes, including equities. The iShares National AMT-Free Muni Bond (MUB) provided a 3.3% return last year compared to 2.5% for the S&P 500 (IVV).

Similarly, the iShares California AMT-Free Muni Bond (CMF) returned 3.4% in the same period. Higher returns from municipal bonds also show that they’re relatively less affected by issues such as uncertainty over the US interest rate, a weakness in emerging market economies, and lower commodity prices.

Municipal bonds are less risky

High yield municipal bonds haven’t seen many defaults in the past compared to investment-grade corporate bonds (HYG). This led to fewer redemptions and boosted demand for municipal bonds. So high-yield municipal bond funds are often considered less risky than corporate bonds. Only 0.10% of municipal bonds defaulted in 2014. That’s slightly lower than the 0.11% default rate in the previous year. In contrast, the default rate for corporate bonds averaged 1.5% over the past 32 years.