Do Asian Indexes Point to a Recovery in Global Markets?

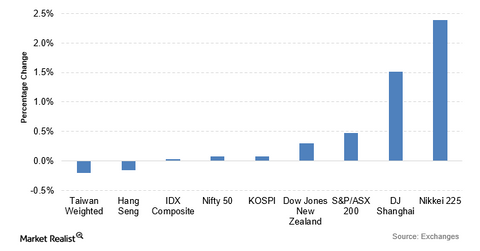

Critical Asian indexes were trading on a mixed note on June 27 with the Japanese and Chinese indexes leading the gains. The Nikkei 225 posted a significant gain of 2.4%, while the Dow Jones Shanghai Index rose by 1.5%.

June 28 2016, Published 11:14 a.m. ET

Could the Asian indexes be pointing to a recovery?

Critical Asian indexes were trading on a mixed note on June 27 with the Japanese and Chinese indexes leading the gains. The Nikkei 225 posted a significant gain of 2.4%, while the Dow Jones Shanghai Index rose by 1.5%.

The Oceania and Indian indexes remained nearly flat for the day, while the Taiwan-weighted index posted the biggest loss among Asian indexes, falling by 0.21%.

Related ETFs fell on the day, with the WisdomTree Japan Hedged Equity Fund ETF (DXJ) falling by 2.3%.

The Australian S&P/ASX 200 was nearly flat. Among related ETFs, the iShares MSCI Australia ETF (EWA) fell by 3.0%, while the Vanguard FTSE Pacific ETF (VPL) fell by 0.96%.

Why Sweden led the fall in European markets

Major European indexes failed to follow the gains in the Asian markets on June 27. The European markets, unlike their Asian peers, are directly influenced by the Brexit vote and are evidently taking more time to recover. However, we did see some improvement when compared to the heavy losses on Friday.

The fall was led by Sweden’s OMXS30 Index, which fell by a significant 8.4% on Monday. The fall was widely expected, since the market was closed on Friday due to a holiday, which meant the reaction to Brexit was reflected in the OMXS30 on Monday. The iShares MSCI Sweden ETF (EWD) fell by 1.5%.

Among major indexes, both the German DAX and the French CAC fell by 3.0%. The Deutsche X-trackers MSCI Europe Hedged Equity ETF (DBEU) was trading on a negative trajectory and fell by 0.78%.

The SPDR Euro Stoxx 50 ETF (FEZ) and the First Trust United Kingdom AlphaDEX Fund (FKU) fell by 2.3% and 8.7%, respectively.

US equities continue their downward trajectory

On June 27, the S&P 500 Index fell by 1.8%, and the NASDAQ Composite Index (IXIC) fell by 2.4%. The markets continued to be under the influence of the ripple effect of the UK referendum on June 23. The fall was also partially attributed to the weak Markit Services PMI (purchasing managers’ index), which we discussed in the first part of this series.

The Dow Jones Industrial Average also fell by 1.5%, and the S&P 500 VIX fell by 7.4%.

In the final part of this series, we’ll look at the effect of the drop in crude oil prices on Latin American markets.