How Sensitive to Interest Rates Has Bank of America Really Become?

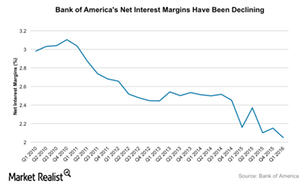

Bank of America’s (BAC) earnings are extremely sensitive to interest rate changes. Low interest rates have weighed on the bank’s top line.

June 9 2016, Updated 9:05 a.m. ET

Interest rate sensitivity

Bank of America’s (BAC) earnings are extremely sensitive to interest rate changes. Low interest rates have weighed on the bank’s top line, and the company has thus been hoping for the Fed to raise rates.

Remember, giant banks’ margins are suppressed when interest rates are low. Banks earn lower returns on their assets as well as lower interest-based income in a low rate environment. But higher interest rates lead to higher net interest income for banks, thereby resulting in higher profitability margins.

But the Fed has retreated from its expected interest rate hikes, and this has led to further margin pressure among titanic banks like BAC.

The Fed and the labor market

If the US Federal Reserve, or the Fed, does raise rates at its June meeting, however, shares of banks like BAC are expected to rise in value. Still, the Fed’s decision to hike interest rates depends on improving labor market conditions, and the disappointing jobs report released on Friday, June 3, has added more uncertainty regarding a rate hike.

The US Labor Department report on June 3 stated that only 38,000 jobs were created in May—much lower than expectations. This slowing job growth lowers the chances of a rate hike in June, thereby delaying net interest income tailwinds for Bank of America. Shares of the company fell by 3% following the US Labor Department’s latest announcement.

Bank of America’s interest rate exposure

To be sure, BAC stands to benefit substantially from a rate hike. This is because it has a large loan portfolio, and net interest income makes up a major part of its revenues. According to the company, a 100-basis-point change in interest rates would lead to a $6 billion increase in BAC’s net interest income, and net interest income comprises ~50% of the company’s total income, representing one of the largest sources of BAC’s revenues.

Notably, BAC has one of the largest loan portfolios in the financial sector (XLF). In 1Q16, it had a loan portfolio worth $901 billion. By comparison, Wells Fargo (WFC) had a loan portfolio of $947 billion, while JPMorgan Chase (JPM), and Citigroup (C) had loans of $847 billion and $619 billion, respectively. This means that Bank of America’s earnings are extremely sensitive to interest rates.

In the next part, we’ll discuss the role of oil prices in BAC’s expected performance in 2Q16.