How Monsanto’s Business Fits into Bayer’s Portfolio

What’s in it for Bayer when it comes to acquiring Monsanto (MON)? The answer lies in Bayer’s business segments and geographic reach.

June 2 2016, Updated 12:06 p.m. ET

Business synergies

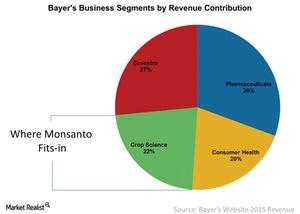

What’s in it for Bayer when it comes to acquiring Monsanto (MON)? The answer lies in Bayer’s business segments and geographic reach. Bayer generates revenue from four segments. Health Care contributes the most to its business, at ~50% in 2015 or 22.6 billion euros. Monsanto is about 9.5% of the VanEck Vectors Agribusiness ETF (MOO).

Bayer’s business segment

Pharmaceuticals and Consumer Health together form the Health Care segment, which contributes 30% and 20% of Bayer’s revenue, respectively. Below, we see how Monsanto’s and Bayer’s combined revenue looks.

Crop Science

Monsanto’s business is the best fit for Bayer’s Crop Science segment, which contributes ~22% of Bayer’s revenue. The Crop Science segment is similar to Monsanto’s business, which deals with crop protection such as insecticides and herbicides as well as crop seeds.

Monsanto’s Seeds & Traits, Herbicides, and SeedGrowth business would have added about 12.7 billion euros to Bayer’s total sales. Crop Science would have accounted for 39% of Bayer’s revenue.

Hurdles

There are several risks to Bayer’s offer. Regulatory review will prove a big challenge. The deal must clear antitrust laws in the United States as well as Europe. But before that process, Bayer must revise its offer higher than $122 per share to convince Monsanto. J.P. Morgan analysts pegged the deal price around $135.

Syngenta (SYT), which also deals in the seeds business, was recently acquired by ChemChina. DuPont (DD) recently merged with Dow Chemical (DOW).