PepsiCo’s Non-Carbonated Beverages Sparkle in 1Q16

In 1Q16, PepsiCo’s North America Beverages segment accounted for 36.8% of the company’s net revenue and 27.5% of the division’s total operating profit.

April 27 2016, Updated 10:05 a.m. ET

Segment performance

In part four of this series, we discussed the performance of two of PepsiCo’s (PEP) North America business segments. In this part, we’ll discuss the performance of PepsiCo’s North America Beverages segment. In 1Q16, PepsiCo’s North America Beverages segment accounted for 36.8% of the company’s net revenue and 27.5% of the division’s total operating profit. The revenue of PepsiCo’s North America Beverage segment increased by 1.5% in 1Q16, driven by higher volumes.

The segment’s operating profit increased 7% due to planned cost reductions, higher revenue, and lower commodity costs.

Still beverage volumes grow stronger

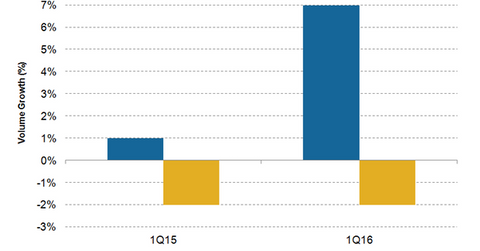

The overall volumes of PepsiCo’s North America Beverages segment increased by 1%, primarily due to strength in the company’s non-carbonated beverage portfolio. The quarter continued to see weakness in soda volumes. In 1Q16, the segment’s overall volume growth was driven by an impressive 7% rise in non-carbonated beverage volume, partially offset by a 2% decline in soda volumes. This compares to a 1% growth in non-carbonated beverage volume and a 2% decline in soda volumes in 1Q15.

PepsiCo’s non-carbonated beverage volume growth in 1Q16 was driven by a double-digit increase in the company’s water portfolio, a mid-single-digit increase in Gatorade sports drinks, and a double-digit increase in the volumes of Lipton ready-to-drink teas.

The weakness in PepsiCo’s soda volumes was evident in 2015 also. In 2015, PepsiCo’s North American Beverages segment reported a 6% increase in non-carbonated beverage volume while the carbonated soft drink volumes declined by 2%.

Coca-Cola (KO) reported a 1% growth in sparkling beverage volumes and a 5% growth in still beverage volumes. Dr Pepper Snapple (DPS) reported a 1% rise in soda volumes and a 4% rise in non-carbonated beverage volumes. Monster Beverage (MNST) is benefitting from the strong demand for energy drinks. According to Beverage Marketing Corporation, the US energy drink volumes increased by 9.8% in 2015 while the carbonated soft drink volumes declined by 1.5%.

Focus on smaller packages

PepsiCo is working on aggressively promoting smaller packages for its soda products. In the 1Q16 conference call, Indra Nooyi, PepsiCo’s chair and CEO, stated that over the past five years, the company has shifted ~6% of its North America carbonated soft drink volume mix from traditional two-liter and 12-ounce multi-pack packages to higher margin, more profitable single-serve and alternative multi-serve packages. This shift has helped in driving higher net price realization for the company and its retail partners. The iShares S&P 500 Growth ETF (IVW) has 0.9% exposure to PepsiCo.

We’ll discuss the company’s profitability in the next part of this series.