Sizing up Stryker’s Business Model in 2015

Stryker offers a diversified portfolio of more than 60,000 products and services, with a focus on quality outcomes at lower costs through collaborations.

Dec. 28 2015, Published 3:05 p.m. ET

An overview of Stryker’s business

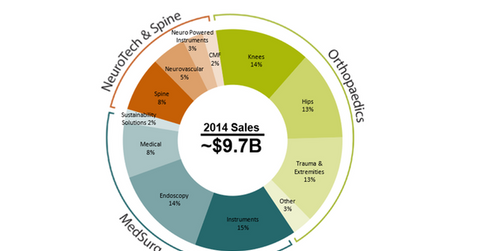

Stryker Corporation (SYK) offers a diversified product portfolio across a broad range of more than 60,000 products and services, with a focus on providing quality outcomes at lower costs through partnerships and collaborations with physicians and hospitals. The company’s business is structured around physician specialties and is segregated into following segments:

- Orthopedics

- Medical and Surgical, or MedSurg

- Neurotechnology and Spine

Stryker’s Orthopedics segment

Stryker’s Orthopedics segment consists of implants used in hip and knee joint replacement and trauma and extremities surgeries. It is the largest business segment of Stryker and generated approximately 43% of the company’s total revenues in 2014.

Stryker is the second-largest company in the orthopedics market in the United States—second to Depuy Synthes, the orthopedics arm of Johnson & Johnson (JNJ). It operates primarily in hip and knee orthopedic devices, which constitute approximately 34% and 31%, respectively, of the segment’s total revenues.

Stryker’s MedSurg segment

MedSurg is Stryker’s second-largest segment and consists of approximately 39% of the total revenues generated by the company in 2014. This segment is further segmented into following sub-divisions:

- instruments, which include various surgical instruments and navigation systems

- endoscopy, which includes various endoscopic and communication systems

- medical, which consists of patient handling and emergency medical equipment

- sustainability solutions, which consists of reprocessed and remanufactured medical devices

Stryker’s major competitors in this segment are Zimmer Biomet (ZBH), Medtronic (MDT), and ConMed Linvatec, a subsidiary of CONMED corporation.

Stryker’s Neurotechnology and Spine segment

Stryker’s Neurotechnology and Spine segment consists of neurovascular as well as neurosurgical products and spine implants for the treatment of spinal injuries and deformities. This segment accounted for around 18% of the company’s total revenues in 2014. Stryker’s major competitors in this segment include Medtronic, Johnson & Johnson, Nuvasive, and Globus Medical.

The First Trust Health Care AlphaDEX Fund (FXH) is a fund that tracks a US healthcare companies index and aims to achieve returns on the basis of growth and the value profile of companies. Investors seeking exposure to Stryker Corporation (SYK) can invest in FXH, which has an exposure of around 1.3% to Stryker.

Now let’s take a closer look at Stryker’s Orthopedics segment.