Why Same-Store Sales Surged for Home Depot and Lowe’s

Home Depot’s same-store sales grew 5.1% overall, marking the 18th straight quarter of positive comps for the retailer.

Nov. 20 2015, Published 9:50 a.m. ET

Analyzing same-store sales trends for Home Depot and Lowe’s in fiscal 3Q16

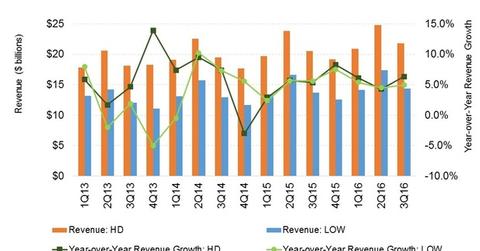

The Home Depot (HD) reported sales of $21.8 billion in 3Q16, up 6.4% year-over-year. Same-store sales grew 5.1% for HD overall, marking the 18th straight quarter of positive comps for the retailer. Store comps rose even more in the US, by 7.3%, in fiscal 3Q16.

According to Craig Menear, chair, CEO, and president of HD, “During the quarter, we saw broad-based growth across our geographies and product categories, led by growth in transactions from both our DIY and Pro customers.” Comps also came in positive in each reporting region, all its top 40 markets, and in each merchandising category. Store comps in Canada and Mexico were positive for the 16th and 48th consecutive quarter, respectively, in constant currency terms.

Lowe’s comps continue on growth trajectory

In contrast, Lowe’s (LOW) grew its top line by 5% in fiscal 3Q16 to $13.4 billion. Store comps grew 4.6%, marking the tenth straight quarter of same-store sales growth. Comps came in positive in all 14 regions and 12 out of 13 product categories.

Performance drivers

A higher number of transactions, as well as an increase in the ticket size spurred sales growth for both Home Depot and Lowe’s. Greater traction was seen in larger ticket sizes.

- Average ticket size rose 0.8% for Home Depot and 2% for Lowe’s.

- The number of transactions rose 4.4% for Home Depot and 2.5% for Lowe’s.

- Transactions with a ticket size greater than $500 rose by 7.2% for Lowe’s.

- Transactions with a ticket size greater than $900 rose by 7.8% for Home Depot.[1. As per comments by Ted Decker – The Home Depot EVP, Merchandising]

Home goods and furniture specialty retailer Restoration Hardware (RH) grew same-store sales by 16% in its last quarter, partly as a result of its strong e-commerce performance.

Home Depot is the third largest holding in the Consumer Discretionary Select Sector SPDR Fund (XLY), accounting for 6.6% of the ETF’s portfolio. HD is also the fourth largest holding in the SPDR S&P Homebuilders ETF (XHB), accounting for 3.6% of the ETF’s portfolio.