How Arch Coal’s Rise in Bituminous Thermal Coal Volumes Hurt Prices in 3Q15

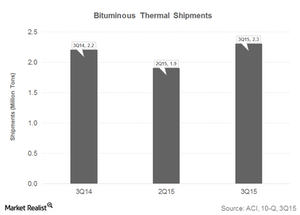

Arch Coal’s Bituminous Thermal coal segment sold 2.3 million tons in 3Q15 compared to 2.2 million tons in 3Q14 and 1.9 million tons in 2Q15.

Nov. 20 2020, Updated 1:19 p.m. ET

Arch Coal’s bituminous thermal segment in 3Q15

Arch Coal’s (ACI) bituminous thermal coal segment sold 2.3 million tons in 3Q15 compared to 2.2 million tons in 3Q14 and 1.9 million tons in 2Q15. The company’s bituminous thermal segment includes West Elk mine in Colorado and Viper mine in the Illinois Basin. Shipments saw an increase due to higher production at the West Elk mine and warmer weather across the US.

Pricing, natural gas, and the Illinois Basin

The price per ton for Arch Coal’s bituminous thermal coal in 3Q15 came in at $30.20, which was down from $31.81 in 3Q14 and $30.37 in 2Q15 despite higher shipments. This lower pricing was according to terms of contracts with customers.

Meanwhile, weak natural gas prices put tremendous pressure on thermal coal spot prices in 3Q15, and this also contributed to the segment’s decline in price levels. Illinois Basin benchmark coal, by comparison, was trading at a multiyear low of $32.75 in late October 2015 due to ultra-low natural gas prices. Peabody Energy (BTU) and Alliance Resource Partners (ARLP) also operate in Illinois Basin.

According to the US Energy Information Administration, natural gas surpassed coal (KOL) in market share in electricity generation in July and in August—the first two months of 3Q15. You can stay updated about energy prices by following our coverage of energy and power.

Western bituminous segment revenues

Arch Coal’s western bituminous segment reported revenues of $69.4 million in 3Q15, which was down from $70.0 million in 3Q14 but up from the $57.7 million it saw in 2Q15.

In the next part of this series, we’ll look more deeply into Arch Coal’s bituminous thermal coal costs in the 3Q15.