Nike’s Free Cash Flow Outlook and Projected Growth Investments

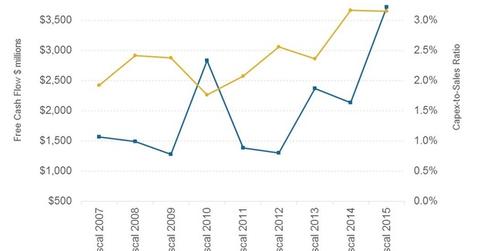

Nike expects to grow its Free Cash Flow, or FCF, at a faster pace compared to net income over the next five years through fiscal 2020. In fiscal 2015, FCF grew by ~74%.

Oct. 23 2015, Updated 11:06 a.m. ET

Nike releases cash flow growth projections

Nike (NKE) expects to grow its Free Cash Flow, or FCF, at a faster pace compared to net income over the next five years through fiscal 2020. In fiscal 2015, FCF grew by ~74%, compared to the 21.5% growth in net income. The growth in FCF has been supported by Nike’s expanding margins, and a slight fall in capital expenditure relative to sales.

Capital expenditure

Over the next few years, Nike expects to spend ~4% of sales on capital expenditure to finance its global growth. That’s the highest the company has ever spent on capital expenditure, relative to sales, historically-speaking. The higher investment can be attributed to the larger owned stores footprint, higher investments in digital and e-commerce, manufacturing practices and supply chain, all aimed at driving gross margin improvements and adding scale to operations.

Leverage

Nike hasn’t disclosed how it’s planning to fund its capital expenditure. But historically, its funded most of its growth initiatives through internally generated cash. Nike and its peers employ low levels of leverage. Their business models are strong cash generators. Nike’s total debt-total assets ratio is 5.8%, compared to:

- 0% for Lululemon Athletica (LULU)

- 7.1% for Skechers (SKX)

- 13.6% for Under Armour (UA)

- 14.5% for VF Corporation (VFC)

- 15.1% for Adidas (ADDYY)

Under Armour’s debt levels have risen this year with the acquisition of its fitness app firms Endomondo and MyFitnessPal. Under Armour took on debt to finance the acquisitions.

Share repurchases

Nike also employed its FCF for paying dividends and buying back its own shares. Nike has an $8 billion share repurchase program in place, authorized in September 2012. Of this, shares worth $6.5 billion were repurchased as of the end of the first quarter of fiscal 2016.

This includes ~$2.5 billion in share buybacks in fiscal 2015, where 29 million shares were purchased at an average cost of $87.37.

Funding growth and shareholder payouts

As a mature company with strong demand, Nike been able to fund its growth with internal generations. It also pays a dividend, unlike younger and faster-growing peers Under Armour, Skechers, and Lululemon Athletica.

The next article discusses Nike’s projected shareholder returns over the next five years.

Nike makes up 0.13% of the portfolio holdings in the iShares MSCI USA Minimum Volatility ETF (USMV).