Momentum Stocks Don’t Have a High Beta

The healthcare sector, especially the biotech stocks, have garnered momentum over the last few years, as strong earnings growth has excited investors.

Sept. 24 2015, Updated 2:10 p.m. ET

The above relationship is intuitive. During periods of market dislocation, investors tend to gravitate to stocks that are perceived to be safer. What’s less intuitive is isolating which stocks fit into which categories.

For example, investors typically equate higher beta or riskier “glamor stocks” with momentum. However, momentum is often found in unexpected places, such as in healthcare stocks. While the healthcare sector is generally considered “defensive”, with an empirical beta of roughly 0.80 to the market, today healthcare comprises more than 25 percent of the MSCI Momentum Index, versus 15 percent of the S&P 500, based on data from the index providers.

In the short term, an environment of rising volatility is unlikely to be as favorable for momentum as the regime of low and stable volatility we’ve enjoyed over the last few years. As such, investors may want to look for ways to add exposure to complimentary factor exposures, notably quality, which may potentially perform better than momentum in an environment of rising volatility.

Market Realist – Momentum stocks do not have a high beta.

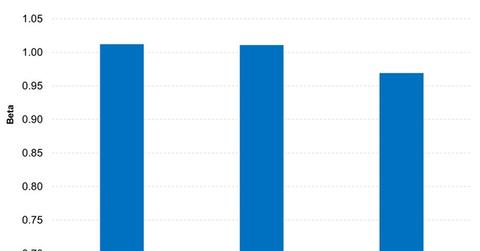

“Beta” is a measure of a fund’s sensitivity to market movements. If a stock has a beta of 1.2, it could perform 20% better than the S&P 500 (SPY)(IVV) in up markets and 20% worse in down markets. Similarly, a stock with a beta of 0.9 indicates that the stock is expected to perform 10% worse than the market during up markets and 10% better during down markets.

The Momentum Factor Fund (MTUM) has a beta of 1.01, considering weekly returns over the last two years. Surprisingly, the quality factor fund (QUAL) has the same beta over that period, while the health care sector has a beta of 0.96 in that period.

The healthcare sector (XLV), especially the biotech stocks (IBB), have garnered momentum over the last few years, as strong earnings growth has excited investors. The biotech stocks trade at a premium because of their strong earnings and high potential. The valuations of these stocks reflect a lot of expectations. Thus, when volatility spiked recently, the sector was one of the hardest to be hit. The biotech sector fell by 4.4% on August 24.

Read Implementing a Factor-Based Smart Beta Investing Strategy for more on investing in factor funds.