A Glance at Family Dollar’s Historical Performance

Over the last five years, Family Dollar was able to generate a five-year CAGR revenue of 7.2%. That looks decent when you look at it alone. But let’s compare it to its peers.

Sept. 21 2015, Updated 12:05 p.m. ET

About Family Dollar

Family Dollar, like Dollar Tree Stores (DLTR), was a chain of discount variety stores. But unlike Dollar Tree, which sells all its products at a fixed price of $1, Family Dollar had products in the range of $1–$10. It had more than 8,000 stores in more than 46 states.

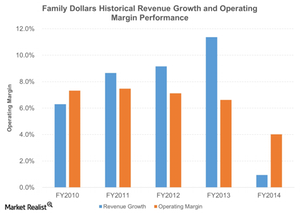

Revenue growth

Over the last five years, Family Dollar was able to generate a five-year CAGR (compounded annual growth rate) revenue of 7.2%. That looks decent when you look at it alone. But compare it to its peers Dollar General (DG) and Dollar Tree (DLTR), which generated CAGR revenue of 10.9% and 10.5%, respectively, for the same period.

Family Dollar comes in below par since after the recession of 2008–2009, people in the United States became price-conscious, and revenues of discount stores like Family Dollar and Dollar Tree Stores (DLTR) were on the upswing.

Operating margin

Operating margin has also been a concern for Family Dollar over the years. It has averaged a 6.5% operating margin over the last five fiscal years. Its peers have been averaging almost 350–400 bps (basis points) more than Family Dollar. That’s huge in a discount retail store business considering the fact that prices have to be very competitive. So margins are something discount retailers strive to maximize.

What you can expect from Dollar Tree after the deal

Dollar Tree Stores’ (DLTR) acquisition of Family Dollar was completed on July 6, 2015. Dollar Tree paid $9.1 billion for the deal, with $6.8 billion being paid in cash and the rest by issuing shares worth $2.3 billion.

It’s interesting to note that the acquisition goodwill was 53%. That’s $4.82 billion of the total purchase price paid. This means that apart from the tangible assets acquired, 53% of Family Dollar’s value was in its intangible assets like brand recognition, customer base, and future synergies.

The deal has provided Dollar Tree Stores (DLTR) with more than 8,000 stores, a huge assortment of merchandise, and more importantly, a very large customer base. The road ahead for Dollar Tree Stores (DLTR) will be to successfully integrate the Family Dollar business model into its already existing business model, build up its margin, and realize the synergies of the acquisition.

Dollar Tree has already declared a $300 million run-rate synergy annually from the acquisition. It will be interesting to see if Dollar Tree (DLTR) is able to realize the value or if the acquisition goodwill remains just a plug value.

Investors can get exposure to Dollar Tree Stores (DLTR) by investing in the SPDR S&P Retail ETF (XRT). XRT has exposure to 100 prominent retail US stocks such as Amazon.com (AMZN) at 1.15%, Walmart (WMT) at 0.94%, and Tiffany (TIF) at 0.81%.