Advantages and Disadvantages of Investing in REITs

Every investment comes with certain advantages and disadvantages. REITs are no exception. There are benefits and risks associated with investing in REITs.

Aug. 25 2015, Updated 11:07 a.m. ET

Benefits and risks

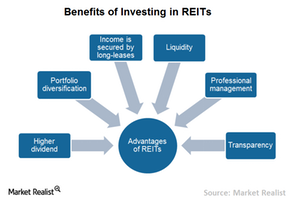

Investors invest in REITs mainly for higher income and for long-term growth. REITs also help investors diversify their income streams. However, every investment comes with certain advantages and disadvantages. REITs are no exception. In this part, we’ll examine some of the benefits and risks associated with investing in REITs.

First, we’ll discuss some of the benefits of investing in REITs.

Higher dividend

- The requirement to pay at least 90% of their income as a dividend is a primary reason why investors buy REITs like Simon Property Group (SPG).

Portfolio diversification

- Generally, real estate prices aren’t correlated to stock prices. They can move together or in completely opposite directions. Adding REITs to a diversified investment portfolio may provide much-needed diversification.

Income is secured by long leases

- REITs like Equity Residential (EQR) own physical assets and often have long-term lease contracts with their tenants. This leads to a secure and stable income stream over a longer period.

Liquidity

- REIT shares are traded on the major stock exchanges. This makes buying and selling very easy. In contrast, buying and selling property requires a lot of effort, expense, and expertise.

Professional management

- REITs like Ventas (VTR) are managed by highly skilled and experienced real estate professional managers. Average investors may not have the skills to manage high-income bearing properties.

Transparency

- The SEC (U.S. Securities and Exchange Commission) registered REITs are required to make regular disclosures. This makes REIT operations more transparent to investors.

Now, let’s go through some of the risks associated with investing in REITs.

Grow at a slower pace

- REITs can only reinvest a maximum of 10% of their annual profits back into their core business lines each year. This may cause some of the REITs to grow at a slower pace than a normal company on Wall Street.

May rely on debt

- A higher dividend payout by many REITs like Ventas (VTR) may force management to go for higher leverage to expand real estate holdings. This would result in higher interest going out. This would reduce their earnings. In contrast, expansion in real estate holdings may create additional sources of income for leveraged REITs.

Real estate is a cyclical business

- Although REITs like Simon Property Group (SPG) have to pay at least 90% of their income as a dividend, their income stream isn’t guaranteed. Cyclical downturns in the real estate market could make REITs business unstable.

Tax treatment

- REITs like Equity Residential (EQR) are required to pay at least 90% of their disposable income to the unitholders. They don’t have to pay taxes on profits. However, investors will have to pay income tax on the annual dividend as though it’s personal income, not a capital gain, once it’s distributed. So, investors in the higher tax bracket may be at a disadvantage because they have to pay higher taxes.

Property taxes may rise

- State and municipal authorities have the right to increase property taxes to increase their budget revenue. This reduces REITs’ earnings.

Investors looking for diversification in the REIT sector can get exposure in REIT ETFs like the Vanguard REIT ETF (VNQ) and the iShares Cohen & Steers REIT ETF (ICF).