EOG Resources: Growing Revenue Is Battered by the Crude Oil Slump

EOG Resources’ 1Q15 adjusted revenue fell 39% quarter-over-quarter. This was mainly a result of the fall in crude oil and natural gas prices starting in 2H14.

June 26 2015, Published 1:53 p.m. ET

EOG’s revenue

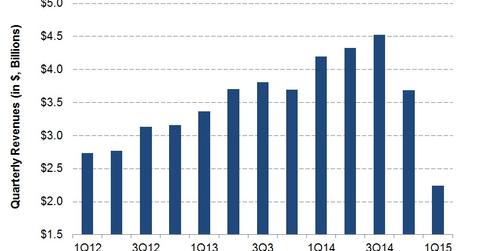

EOG Resources’ (EOG) revenue had grown steadily over the past several quarters, before it fell off in 4Q14. Recently, EOG Resources’ 1Q15 adjusted revenue fell 39% quarter-over-quarter. This was mainly a result of the fall in crude oil and natural gas prices starting in 2H14. Excluding the impact of EOG Resources’ hedging activity and asset dispositions, crude oil, NGL (natural gas liquid), and natural gas 1Q15 sales fell by ~37% quarter-over-quarter.

Compared to 1Q14, EOG Resources’ adjusted revenue fell 47% in 1Q15.

Peer comparison

In comparison to EOG Resources, upstream peer Suncor Energy’s (SU) 1Q15 revenue fell 31% from last year, while EQT’s (EQT) revenue remained almost unchanged during the same period. Upstream MLP (master limited partnership) Atlas Resource Partners’ (ARP) 1Q15 revenue rose by 52.1% YoY (year-over-year), while the revenue for EV Energy Partners (EVEP) fell by 50.4% YoY during the same period. EOG Resources accounts for 3.95% of the Energy Select Sector SPDR ETF (XLE).

Factors affecting EOG’s revenue

Two primary drivers for EOG Resources’ revenue are:

- energy prices

- volumes sold

From 1Q12 to 3Q14, EOG’s revenue rose 65%. Since then, it has taken a sharp southward turn. Between 1Q12 and 3Q14, WTI (West Texas Intermediate) crude oil prices remained high. They moved within a range of $77–$110 per barrel. Since October 2014, WTI crude fell by 34%. For a detailed discussion on EOG Resources’ volume and realized prices, read the next part of this series.

Other factors affecting EOG Resources’ revenue

- gains or losses on commodity derivative contracts – In 1Q15, EOG Resources recorded $76.2 million in gains on mark-to-market derivatives contracts—compared to a $155.7 million loss in 1Q14.

- gains or losses on asset dispositions

- revenue from crude oil gathering, processing, and marketing activities

EOG Resources’ product-wise revenue breakup

In 1Q15, all three of EOG Resources’ primary products—crude oil and condensates, NGLs, and natural gas—registered a fall in revenue. Over 1Q14, NGLs posted the steepest fall of 54%, followed by natural gas at 48% and crude oil and condensates at 47%.