Verizon’s Revenue Growth Should Slow down in 1Q15

Verizon (VZ) will report its 1Q15 results on April 21, 2015. It’s the largest US telecom company. It had a market capitalization of $200.08 billion as of April 13, 2015.

Dec. 4 2020, Updated 10:53 a.m. ET

Verizon’s revenue growth in 1Q15

Verizon (VZ) will report its 1Q15 results on April 21, 2015. In this series, we’ll look at how these results will turn out. Verizon is the largest US telecom company. It had a market capitalization of $200.08 billion as of April 13, 2015. AT&T (T) is the second largest telecom company. It had a market capitalization of $170.65 billion on the same date. Now, we’ll look at Verizon’s expected revenue in 1Q15.

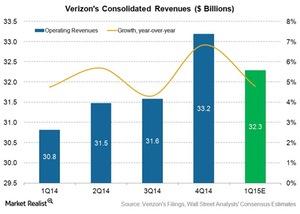

According to Wall Street analysts’ consensus estimate, Verizon is expected to witness ~4.8% YoY (year-over-year) growth in consolidated revenue in 1Q15. This estimate is based on Wall Street analysts’ consensus as of April 13, 2015. However, Verizon beat Wall Street analysts’ consensus revenue estimate in the previous quarter. It reported consolidated revenue of ~$33.2 billion. It beat Wall Street estimates by ~1.5% in 4Q14.

Wireless segment drove Verizon’s revenue growth in 4Q14

Wall Street analysts expect a sequential decline in Verizon’s revenue in 1Q15. This should be due to the seasonal surge in device sales from the company’s wireless segment in 4Q14. As you can see in the above chart, Verizon witnessed robust growth in revenue in 4Q14. Its consolidated revenue grew by ~6.8% YoY during the quarter.

The wireless segment drove this growth. The segment grew by ~11% YoY to ~$23.4 billion in 4Q14. However, the wireline segment dampened the overall revenue growth. During the quarter, its revenue declined by ~1.6% YoY.

You can get diversified exposure to Verizon by investing in the SPDR S&P 500 ETF (SPY). SPY held ~1.1% in the company on March 31, 2015.

You can get more diversified exposure to Verizon by investing in the iShares MSCI ACWI ETF (ACWI). ACWI held ~0.5% in the company on the same date. However, investors should be aware that ACWI also held ~0.4% in AT&T and ~0.01% in Sprint (S).