Luxor Capital Establishes New Stake in Cheniere Energy

In February 2015, Cheniere Energy announced that its 4Q14 and full-year results reported a net loss attributable to common stockholders of $158.6 million, or $0.70 per share.

Dec. 4 2020, Updated 10:53 a.m. ET

Luxor Capital and Cheniere Energy

In the fourth quarter, Luxor Capital revealed a new stake in Cheniere Energy (LNG). The fund purchased 709,801 shares in the company during the fourth quarter and this position now represents 1% of the fund’s US long portfolio.

Company profile

Cheniere Energy is a Houston-based energy company. The company is primarily engaged in businesses related to LNG (liquefied natural gas). Cheniere owns and operates the Sabine Pass LNG receiving terminal. The company also operates the Creole Trail Pipeline through a partial ownership interest and management agreements with Cheniere Energy Partners LP, a publicly traded partnership created in 2007.

Cheniere Energy owns 100% of Cheniere Energy Partners’ general partner, Cheniere Energy Partners GP. Also, Cheniere Energy owns an 84.5% general partner interest in Cheniere Energy Partners LP Holdings (CQH), a publicly traded, limited liability company formed in 2013. Cheniere also owns 100% of Cheniere Marketing and the Corpus Christi liquefaction project.

EIG Management funds Cheniere Energy for LNG project

In January 2015, Cheniere Energy announced that it completed and finalized a funding agreement with EIG Management Company, a private equity firm. According to the agreement, EIG Management will buy convertible notes from Cheniere Energy worth $1.5 billion. The proceeds will be used to fund a portion of the costs of developing, constructing, and placing into service the Corpus Christi liquefaction project.

The company expects the purchase of the convertible notes to be completed in the first half of 2015. The Corpus Christi Liquefaction project is expected to cost $11.5 to $12 billion.

Cheniere partners with Kinder Morgan

In December 2014, Kinder Morgan (KMI) announced that it signed a 15-year contract for transportation and storage for its Corpus Christi liquefaction project. According to the contract, Kinder Morgan will provide transportation service for 550,000 dekatherms per day (or Dth/d) of natural gas, which can increase to 800,000 Dth/d after the expansion of its pipeline system in Texas.

Also, Kinder Morgan will provide storage services to accommodate 3 billion cubic feet of natural gas in order to serve the Corpus Christi liquefaction project.

Cheniere’s 4Q14 results miss estimates

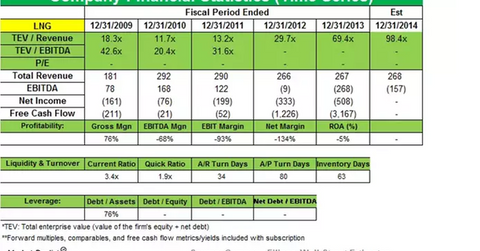

In February 2015, Cheniere Energy announced that its 4Q14 and full-year results reported a net loss attributable to common stockholders of $158.6 million, or $0.70 per share, compared to a net loss of $135.2 million, or $0.61 per share for 4Q13. For the year ending December 31, 2014, the company reported a net loss of $547.9 million, or $2.44 per share, compared to a net loss of $507.9 million, or $2.32 per share, in 2013.

The significant items for full-year 2014 were related to “development expenses primarily for the liquefaction facilities being developed near Corpus Christi, Texas, losses on early extinguishment of debt related to the write-off of debt issuance costs by Sabine Pass Liquefaction in connection with the refinancing of a portion of its credit facilities in May 2014 and April 2013, and derivative gains (losses) due primarily to changes in long-term LIBOR during the respective periods.”

You can gain exposure to Cheniere Energy by investing in the iShares Russell 1000 Growth ETF (IWF). Cheniere Energy accounts for 0.17% of IWF. IWF tracks the performance of 35 companies in the oil and gas sector. Cheniere also makes up 1.0% of the iShares US Energy ETF (IYE), which includes around 95 US energy stocks with top holdings Exxon Mobil (XOM), Chevron (CVX), and Schlumberger (SLB) forming ~44% of its portfolio.

In the next part, we’ll discuss Luxor Capital’s new position in AT&T (T).