Highlights of Bridgewater Associates’ New Positions in 4Q14

Ray Dalio’s Bridgewater Associates filed its fourth-quarter 13F in February 2015. In 4Q14, the fund had opened four new positions.

April 18 2015, Updated 12:40 a.m. ET

Bridgewater Associates’ new positions in 4Q14

Ray Dalio’s Bridgewater Associates filed its fourth-quarter 13F in February 2015. In 4Q14, the fund had opened new positions in Potash Corporation of Saskatchewan (POT), United States Steel Corporation (X), Wynn Resorts (WYNN), and Center Point Energy (CNP).

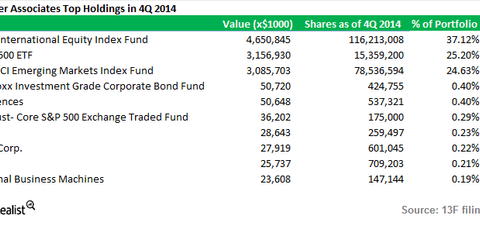

The hedge fund’s US long portfolio was worth $12.52 billion, according to the 13F filings for the fourth quarter. This was down from $12.82 billion in the third quarter.

Top 10 holdings

The Vanguard International Equity Index Fund (VNQI), the SPDR S&P 500 ETF (SPY), and the iShares MSCI Emerging Markets Index Fund (EEM) made up the majority of Bridgewater’s total US long portfolio in the fourth quarter. These funds were Bridgewater’s top three holdings, as outlined in the chart above. The rest of the portfolio comprised 330 stocks.

Overview of Bridgewater Associates

Bridgewater Associates is an American hedge fund founded by Ray Dalio in 1975. The firm manages ~$157 billion in global investments for a wide array of institutional clients:

- foreign governments

- central banks

- corporate pension funds

- public pension funds

- university endowments

- charitable foundations

The next article in this series will discuss Bridgewater’s new position in Potash Corporation of Saskatchewan.