How valuation of insurance companies works

Financial market movements not only impact income from invested assets, but also the value of assets carried at fair value on an insurer’s balance sheet.

Nov. 19 2019, Updated 6:12 p.m. ET

Relative valuation

Because insurers are balance sheet–driven businesses, common metrics for a multiple-based valuation of insurance companies would include book value or embedded value. However, one should adjust such metrics to avoid distortion due to intangible assets. So, tangible book value is also a key metric.

Used mainly for European and Asian life insurers, embedded value is attributable from the business already written. Embedded value doesn’t account for future sales or the adjusted shareholders’ net worth.

Risk profiles

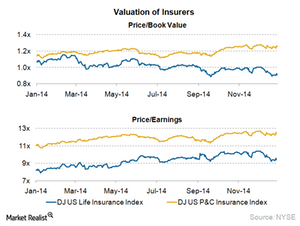

Life insurers tend to trade at a discount to P&C insurers due to a higher risk profile, which arises from the long-term nature of the business. For example, life insurance carriers have a higher exposure to long-term interest rates. An investor can participate in this sector through sector-specific ETFs like the SPDR S&P Insurance ETF (KIE).

It is difficult to assess insurers based on earnings due to uncertainty in timings of claims. This may result in distortion in accounting earnings, and it may also be due to movements in financial markets and macro-economic indicators. Financial market movements not only impact income from invested assets, but also the value of assets carried at fair value on an insurer’s balance sheet.

Estimating cash flows

Insurers can also be valued by a discounted cash-flow methodology. Using this methodology, we can arrive at the value of a life insurer as a sum of its embedded value (or the value of existing business) plus its value from future sales (known as franchise value). However, valuation of life insurance companies using discounted cash flow is difficult, as the timing of the cash flows are uncertain due to the long-term nature of the contracts. These companies include MetLife (MET), Prudential Financial (PRU), and AFLAC (AFL).

Valuing P&C insurers or reinsurers by cash flow methodologies is relatively less complex, especially in the case of short-tailed businesses. The uncertainty regarding the timing of cash flows is lower in case of such products offered by companies such as AIG (AIG) and ACE (ACE). The value of a P&C insurance business can be assumed to be the discounted value of after-tax cash flows arising from the business.