SWOT analysis of Rockwell Collins

Rockwell Collins expects its Airborne Solutions/Avionics division to see good growth in the future due to the rising demand in Unmanned Air Vehicles (or UAVs).

Jan. 5 2015, Updated 8:29 a.m. ET

SWOT analysis

To assess its prospects for the coming years, we will perform a SWOT analysis of Rockwell Collins. Standing for strengths, weaknesses, opportunities, and threats, a SWOT analysis offers an easy-to-comprehend overview of the factors that impact any organization. Strengths and weaknesses reflect a company’s internal aspects, which it can control. Opportunities and threats reflect external factors over which the company has little control.

Strengths

Rockwell Collins’s (COL) biggest strength is its Research and Development department, which has a strong and talented pool of professionals. The R&D department focuses on innovation to stay ahead in the cutthroat competition in the aerospace industry.

Another important strength of the company is its wide range of products, which maintains its diversified product range. It also lowers its business risk and opens up market opportunities.

Weaknesses

Rockwell Collins relies heavily on the US government for contracts. With the government looking at making various budget cuts in the near future, this would adversely affect the company’s revenues.

In the aerospace industry, customers exert considerable bargaining power, as they possess a great deal of information and work to position themselves as the best option.

Opportunities

Rockwell Collins expects its Airborne Solutions/Avionics division to see good growth in the future due to the rising demand in Unmanned Air Vehicles (or UAVs).

The company has a growing backlog, which indicates significant demand for the company’s products and services in the market. Plus, this assures stable revenue growth for the company.

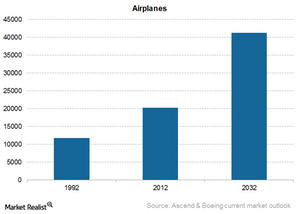

With aircraft companies eyeing newer markets such as the BRICS nations (or Brazil, Russia, India, China, and South Africa), as well as the Middle East, growth in aircraft requirements offers good prospects for Rockwell Collins to increase its revenues.

Threats

Rockwell Collins’s competitors are mostly larger in both scale and size, making it a challenge for COL to acquire larger contracts. Since the company has fixed price contracts, if it exceeds its cost estimates or faces delays, then these contracts face a threat of becoming unprofitable.

The company depends on critical suppliers and subcontractors, and it does not always have an alternate supply source available. Any issues on a supplier’s end could adversely affect the company.

Rockwell Collins is part of the Aerospace & Defense ETF (PPA). This ETF also includes Textron (TXT), Northrop Grumman (NOC), and General Dynamics (GD).

In our next article, we will look at the company’s strategy to counter declining government sales.