Why Are State Foreclosure Laws Important?

There are two basic types of state foreclosure laws—judicial and non-judicial. In non-judicial states, foreclosures are handled through a streamlined process.

July 19 2016, Published 9:05 a.m. ET

State foreclosure laws impact foreclosure inventory

There are two basic types of state foreclosure laws—judicial and non-judicial. In non-judicial states, foreclosures are handled through a streamlined process. They usually take a few months. In judicial states, foreclosures can take years. Judges are often reluctant to push delinquent borrowers out of their homes.

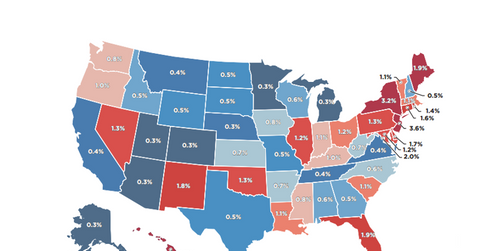

As you can see from the above map, the states with the largest foreclosure inventories—New York, New Jersey, and Florida—have judicial foreclosure processes.

State foreclosure laws impact home price appreciation

Home price appreciation varies widely by location. In California, the foreclosure pipeline has been worked through. We’re seeing price appreciation and bidding wars reminiscent of the peak of the bubble years.

In the judicial states—particularly New York, New Jersey, and Connecticut—we’re seeing much lower home price appreciation. New York’s foreclosure percentage is 3.2%, New Jersey’s is 3.6%, and Florida’s is 2.0%. All three states are down 0.0%–0.1% over the past month.

The home price appreciation in California and Colorado, where foreclosure percentages are below 0.4%, has been double the home price appreciation in the Northeast.

The problem with much of this inventory is that it isn’t sellable. In judicial states, many homes sit vacant for years. They fall into disrepair and become more expensive to fix than they’re worth. This created problems in many localities. It’s why you see many vacant homes worth $10,000 with $100,000 mortgages on them. This is the effect of depressing prices, especially in areas such as the Rust Belt where vast swaths of cities are vacant.

State laws also impact the value of mortgage servicing rights. Typically, mortgage servicing rights in states such as New York and New Jersey trade at a 25% discount to other states. This reflects the regulatory environment.

Implications for mortgage REITs

Real estate prices are a bigger driver for non-agency REITs such as Two Harbors Investment (TWO) than they are for agency REITs such as Annaly Capital Management (NLY) and American Capital Agency (AGNC).

Prices also impact originators such as PennyMac Mortgage Investment Trust (PMT) and Redwood Trust (RWT). Investors who are interested in trading in the mortgage REIT sector can look at the iShares Mortgage Real Estate ETF (REM).

When prices rise, delinquencies fall. This is important because non-agency REITs face credit risk. For agency REITs that invest in government mortgages, rising real estate prices can drive prepayments. This is negative for returns.

Rising real estate prices also help reduce the stress on the financial system. This makes securitization easier. It lowers the cost of borrowing. Finally, REITs with large legacy portfolios of securities from the bubble years are able to stop taking mark-to-market write-downs and may revalue securities upward.