United Parcel Service: A Company Overview

In 2015, United Parcel Service reported total revenues of $58.4 billion. The company’s primary competitor in the US is the Memphis-headquartered FedEx Corporation.

April 7 2016, Updated 9:08 a.m. ET

Company overview

Headquartered in Atlanta, Georgia, United Parcel Service (UPS) is the largest package delivery company in the world. It is a formidable leader in the less-than-truckload industry in the US.

UPS is also a provider of supply chain management solutions around the globe. In over 220 nations and geographies, the company delivers packages on behalf of 1.6 million shipping customers daily. UPS serves every address in North America. Europe UPS delivered 18.3 million packages and documents in 2015.

UPS has a presence in every sphere of the global logistics market. This market includes contract logistics, transportation, distribution, air freight, ground freight, ocean freight, customs brokerage, and insurance and financing. The company operates 104,398 package cars, vans, tractors, and motorcycles, including 6,845-plus non-conventional fuel vehicles. It serves 382 airports in the US and 346 airports internationally.

In the US alone, UPS has air hubs located in Louisville, Kentucky; Philadelphia, Pennsylvania; Dallas, Texas; Ontario, California; and Columbia, South Carolina. In Europe, it has air hubs in Cologne and Bonn in Germany. In the Asia-Pacific region, the company operates through air hubs in Shanghai, Shenzhen, and Hong Kong. Miami, Florida, acts as the Caribbean and Latin American air hub.

Competition

In 2015, United Parcel Service reported total revenues of $58.4 billion. The company’s primary competitor in the US is the Memphis-headquartered FedEx Corporation (FDX). UPS also competes with multiple local, regional, national, and international carriers. In the international arena, UPS competes with worldwide postal services like Deutsche Post, motor carriers, freight forwarders (CHRW), and air couriers (DAL).

Airlines and trucking companies make up 46.3% and 23.6%, respectively, of the portfolio holdings of the SPDR S&P Transportation ETF (XTN).

UPS’s business verticals

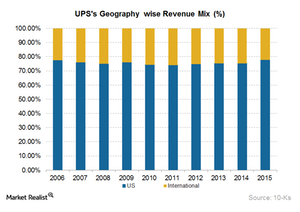

UPS operates through three segments:

- US Domestic Package

- International Package

- Supply Chain and Freight

In the next part of this series, we will look at the US Domestic Package business segment of United Parcel Service.