A closer look at the difference between ETFs and mutual funds

Before moving to inverse and leveraged ETFs in the next part of this series, we’d like to quickly discuss the differences between ETFs and mutual funds.

Nov. 22 2019, Updated 7:18 a.m. ET

ETFs versus mutual funds

Before moving to inverse and leveraged ETFs in the next part of this series, we’d like to quickly discuss the differences between ETFs and mutual funds.

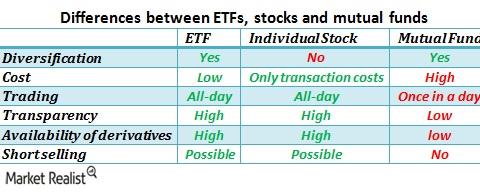

In the previous part of this series, we explained the key differences between actively managed and passively managed ETFs. In this part, we’ll cover the difference between actively managed ETFs and mutual funds. While there are mutual funds that track indices (index funds), most mutual funds remain actively managed. So our reference to “mutual funds” moving forward will include only the actively managed mutual funds. Actively managed ETFs differ from mutual funds on the following counts.

- Expense structure

- Liquidity and settlement

- Disclosures

While actively managed ETFs are more expensive than passively managed ETFs, they tend to be less expensive than mutual funds due to structural differences between these two products. In the case of mutual funds, the investor interacts with the company while buying and selling mutual fund units. The fund house (the company that creates and manages the fund) charges investors fees for entering (entry load) and exiting (exit load) the fund.

As ETFs trade on exchanges, the transactions take place directly between two investors and don’t involve the fund house. This saves the fund house from administrative responsibilities such as bookkeeping, calculating daily returns, and so on, which mutual funds need to take care of. While the Enhanced Short Maturity Strategy Fund (MINT), an actively managed ETF, is more expensive (with expense ratio of 0.35%) than the SPDR S&P 500 (SPY, with an expense ratio of 0.09%), it’s considerably less expensive than most mutual funds.

The second key difference lies in the trading and settlement. While mutual funds can trade only once a day and the net asset value (or NAV) is calculated by the fund house at the end of the day, ETFs trade on exchanges throughout the day and their prices are calculated on an almost real-time basis. This allows ETF investors to day-trade, which mutual fund investors can’t do.

The third key difference between ETFs and mutual funds lies in disclosures and transparency. ETFs, both passive and active, are required to publish their holdings daily, allowing investors to see what’s in the portfolio. On the other hand, mutual funds are required to make disclosures related to their holdings on less frequently. This poses a problem for active ETF managers, as daily disclosures by funds help investors anticipate the next move by the fund manager.

Other differences between actively managed ETFs and mutual funds include the treatment for received dividends, minimum investments, and the availability of derivative contracts.

Within actively managed ETFs, there are ETFs investing in different asset classes and sectors. For example, consider theWisdomTree Dreyfus Chinese Yuan ETF (CYB), which invests in currencies, the Guggenheim Enhanced Ultra-Short Bond ETF (GSY), which invests in T-bills, and the First Trust North American Energy Infrastructure Fund (EMLP), which invests in energy companies like Kinder Morgan (KMI) or Dominion Resources (D). Our focus in this series is two kinds of actively managed ETFs—inverse ETFs and leveraged ETFs. Read on to the next part of this series to find out more about these ETFs.