Why we could see a new trend in Japan’s exports and imports

Japan’s import and export dynamics The below graph provides a clearer picture of the import and export dynamics of the Japanese economy. By using 2005 as a base year and adjusting for inflation or deflation, the graph shows how exports and imports have changed on a “real” basis, as opposed to a “nominal” basis. Viewing […]

Nov. 20 2020, Updated 4:53 p.m. ET

Japan’s import and export dynamics

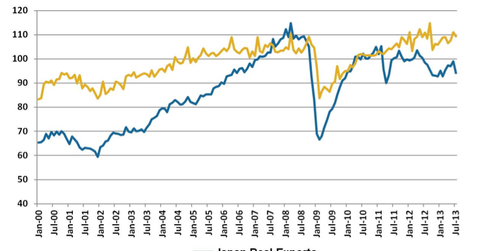

The below graph provides a clearer picture of the import and export dynamics of the Japanese economy. By using 2005 as a base year and adjusting for inflation or deflation, the graph shows how exports and imports have changed on a “real” basis, as opposed to a “nominal” basis. Viewing import and export growth on a real basis accounts for inflation or deflation, which are affected by changes in the currency and other economic factors.

The above graph of real exports and imports provides even greater contrast to the export and import changes described by the prior graph in Part 1 of this series. On a “real” basis, neither imports nor exports have changed much this past year. The first graph in this series reflected nominal growth of nearly 20% for both imports and exports this year. These growth rate differentials reflect the effect of the weakening yen post-2013. Export growth in dollar terms is growing more slowly than in yen terms, suggesting that the large majority in recent export growth has been driven by the weaker Japanese yen—and not by a real growth in the actual volume of exports.

Japan could awaken from its economic slumber

As the above graph reflects, on a real basis, Japanese exports appear to be growing more slowly than on a nominal basis since 2010, and may appear to be lagging imports. However, note that in 2002, exports were at a mere 60% of the 2007 level, while imports were at a lofty 85% of the 2005 level. From this perspective, you should note that export growth had handsomely outperformed import growth during the prior business cycle. Real exports appear to be a little slow out of the gate in the current business cycle, though should the same pattern of real exports outperforming real imports repeat itself with the same ferocity as the prior business cycle, Japan may very well awaken from its economic slumber.

Going forward, it might appear that Japan could be a larger importer than exporter for some time, though we ‘re too early in the current business cycle, as well as “Abenomics”-led reforms, to tell if this trend will last much longer. At least on a nominal basis, as illustrated in the first graph in this series, this would appear to be a very new and important development. As far as real exports outpacing real imports versus a 2005 base, real growth might require a more robust global economy, and solid consumption in both the United States and European Union. For the time being, import growth looks fairly robust—but watch out for a spike in nominal and real export growth over the next 12 months. It’s possible that both real and nominal export growth could lag both real and nominal import growth in the near term, though it’s important to see if this trend will change in the future. In other words, as the yen weakens and economic growth starts to accelerate, imports may initially outpace exports—though real export growth may eventually outpace real import growth, as was the case in the prior business cycle.

Trade improvements for Japan

Regarding real versus nominal export and import data as described in the above graph, it’s important to note that the price of oil peaked at $145.30 in July 2008, was at $50 per barrel in 2005, and fell closer to $25 per barrel in 2000. Japan imports significant amounts of crude oil, which provides over 40% of Japan’s power needs. As such, when focusing on the future trend of “real” versus “nominal” export or import data, “real” data prior to the 2005 base year is subject to significant adjustments related to intermediate goods-related inflation or deflation. These adjustments include crude oil imports as well as other exchange rate–related factors.

Regardless, the Japanese export growth machine adapted to both oil and strong currency challenges from 2002 through 2008, despite oil quadrupling in price and the currency appreciation of 33%. It’s unlikely that oil will quadruple in the current post-2008 business cycle, and the Japan export machine will likely be less affected by a rapid increase in the cost of power, as was the case in the prior business cycle. In fact, given the global growth dynamics of fuel supply, oil prices should remain fairly soft. In 2011, the United States exported more gasoline, diesel, and other fuels than it imported for the first time since 1949. It’s quite possible that oil prices could remain flat or even decline significantly during the next business cycle. In other words, Japan could see its “terms of trade” improve vis-à-vis China and Korea.

Outlook

Looking forward, you should note that significant changes are taking place in Japanese export and import dynamics. While the apparent divergence in greater imports versus exports seems somewhat new and insignificant at a casual glance, this trend merits watching closely because the new economic dynamics of the post-2008 business cycle could lead to a very significant and ongoing change in the trend of Japanese exports and imports on both nominal and real bases.

Should import growth continue to outpace export growth (as has been the case in the past year or two), this trend could reinforce the weakening of the yen and further support the growth in profit margins of Japanese exporters, thereby accelerating the improvement of Japan’s “terms of trade.” As such, Wisdom Tree Japan Hedged (DXJ) and the iShares MSCI Japan (EWJ) may continue to outpace China’s iShares FTSE China 25 Index Fund (FXI) and Korea’s iShares MSCI South Korea Capped Index Fund (EWY).

RELATED ARTICLES BY COUNTRY

-

CHINA: For further analysis of how CHINA is being affected by JAPAN and “Abenomics,” please see CHINA SERIES—“The Golden Age of Cheap Labor Coming to an End?”

-

USA: For further analysis of how USA-related CONSUMPTION trends could impact JAPAN’S Abenomics-led recovery, please see USA SERIES, “US Consumer Spending–Sustaining the Unsustainable?”