Does “Abenomics” mean a new era of yen depreciation?

A change in yen appreciation? The below graph reflects a potential big change in Japan post-2012—has yen appreciation turned the corner as a result of post-2012 “Abenomics“? In the mid 1970’s, the U.S. dollar bought 300 yen, and by the mid-1980’s, the U.S. dollar bought 250 yen. By the end of the 1980s, the dollar […]

Nov. 20 2020, Updated 3:55 p.m. ET

A change in yen appreciation?

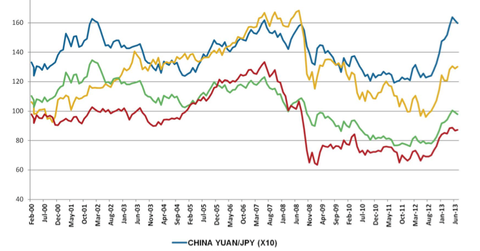

The below graph reflects a potential big change in Japan post-2012—has yen appreciation turned the corner as a result of post-2012 “Abenomics“? In the mid 1970’s, the U.S. dollar bought 300 yen, and by the mid-1980’s, the U.S. dollar bought 250 yen. By the end of the 1980s, the dollar had weakened substantially, and bought only 130 yen. The yen has since continued its long-term appreciation against the U.S. dollar, reaching a record of 75.74 in October 2011. Despite three decades of the yen strengthening from the 300 to the 75 level, Japan still has still managed to maintain a strong manufacturing base by increasing its level of productivity and focusing on higher value-added production goods. The yen currently stands at 98.60 to the dollar as of August 22.

Weakening yen since last election

Since the election of the new Prime Minister, Shinzo Abe, in November 2012, the yen has weakened against the US dollar from the 80 to the 100 level. Prime Minister Abe, in conjunction with Bank of Japan Governor Haruhiko Kuroda, will attempt to end the post-1990 deflationary spiral that has gripped the Japanese economy. These policies, known as “Abenomics,” will attempt to encourage private investment through a more aggressive mix of monetary and fiscal policy. As the above graph illustrates, the Japanese yen appears to have weakened considerably in reaction to these new policies.

Looking forward, what should you look for if the Japanese yen continues to weaken? We’ll discuss the following important factors.

- Will Japanese merchandise exports regain their 2003–2008 growth trajectory, pulling the domestic economy out of a deflationary slump?

- To what extent will the Japanese economy grow in real terms? In other words, will there be growth in both real GDP and real export volumes relative to imports, or will “growth” simply mean that the weakening yen makes dollar-denominated export volume look larger in yen terms?

- Will the yen continue to depreciate against the global currencies, rendering its exports less expensive relative to exports denominated in the currencies of its major export competitors of China and Korea?

- Will the current trend of Japanese equities outperforming Chinese and Korean equities persist, and what will be the relative performance of the Wisdom Tree Japan Hedged (DXJ) and the iShares MSCI Japan (EWJ) versus China’s iShares FTSE China 25 Index Fund (FXI) and Korea’s iShares MSCI South Korea Capped Index Fund (EWY)?

RELATED ARTICLES BY COUNTRY

-

CHINA: For further analysis of how CHINA is being affected by JAPAN and “Abenomics,” please see CHINA SERIES—“The Golden Age of Cheap Labor Coming to an End?”

-

USA: For further analysis of how USA-related CONSUMPTION trends could impact JAPAN’S Abenomics-led recovery, please see USA SERIES, “US Consumer Spending–Sustaining the Unsustainable?”