Follow These Steps to Open an Apple Savings Account

How can you open an Apple Savings account? The tech giant continues to expand its financial services, but does Apple Savings stack up?

April 18 2023, Updated 4:26 p.m. ET

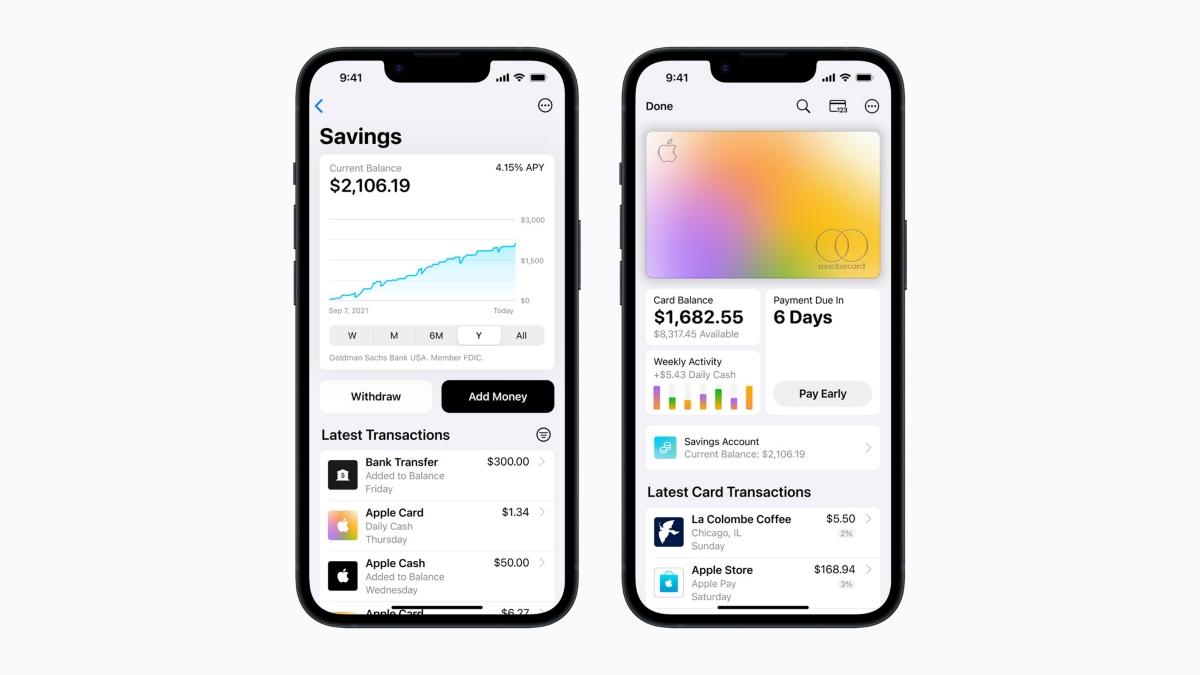

Apple has finally launched its Apple Savings feature, which is available to all Apple Card holders. The accounts will enable users to earn an attractive rate of return on their deposited savings balances, while possibly increasing the appeal of the Apple credit card. Here are all the details on how to open an Apple Savings account and its primary benefits.

The Apple Savings account is a feature that offers savers a high yield on their deposits, without most of the limiting requirements other high-yield savings accounts impose. However, it might not be the highest rate you can earn on your savings, so be sure to shop around.

Here's how to sign up for a Apple Savings account.

First of all, you'll need to have a few things in place to set up an Apple Savings account. Apple Support explains that you need an active Apple Card account (either as owner or co-owner) and you'll need to add that to your iPhone. (You'll need an iPhone that runs iOS 16.4 or later as well.) Other requirements: You must be at least 18 years old, have a Social Security number or taxpayer ID number, and be a U.S. resident with a valid U.S. address.

In order to start your Apple Savings account, first open your iPhone Wallet app and tap "Apple Card." Tap "More," then tap "Daily Cash." You'll see a Savings button, so select "Set up" next to that and follow remaining prompts.

You can transfer funds immediately from your Apple Cash balance to your new Apple Savings account if you wish, or decline if you want to wait. Plus, if you have any Daily Cash that's redeemable as an Apple Card statement credit, the balance will transfer automatically to the Apple Savings account.

Is Apple Savings worth it?

To decide if Apple Savings is right for you, examine the benefits an account can offer you and compare them to similar products from other companies. Thanks to higher interest rates imposed by the Federal Reserve, banks and financial institutions have been raising rates for savers on accounts like Apple Savings.

The primary benefit of the Apple Savings account is a fairly high APY on your balance. The Apple Savings account currently pays 4.15 percent, a competitive rate in the market. As CNET reports, Apple's vice president of Apple Pay Jennifer Bailey stated, "Savings helps our users get even more value out of their favorite Apple Card benefit — Daily Cash — while providing them with an easy way to save money every day."

Another benefit of Apple Savings is there isn't a minimum deposit or balance required to earn the 4.15 percent APY. Daily Cash, which you earn on purchases made through the Apple Card, are automatically funneled into the savings account where they earn interest, and you can make other deposits too.

What are the cons of an Apple Savings account?

Although Apple Savings pays a decent interest rate on your savings balance, 4.15 percent is lower than some of its competitors. CNET notes some competitor rates on high-yield savings accounts:

- UFB – 4.81

- My Banking Direct – 4.38

- Bask Bank – 4.65

- Citizens Access – 4.25

- Bread Savings – 4.50

- Tab Bank – 4.40

Of these, minimum deposits are only required at My Banking Direct ($500) and Bread Savings ($100).

Of course, if you don't already use an iPhone and have an Apple Card, it may not be worth it to get them just for Apple Savings. Since other online banks offer equal or higher rates, it would be easier to open a high-yield savings account with one of them.

Is Apple Savings FDIC insured?

As part of Apple's partnership with Goldman Sachs, Apple Savings account funds are insured by the Federal Deposit Insurance Corporation, or FDIC. Following the collapse of SVB and Signature Bank, consumers are more aware than ever of the value of FDIC coverage, which insures accounts for up to $250,000.