Vanguard High Dividend Yield ETF

Latest Vanguard High Dividend Yield ETF News and Updates

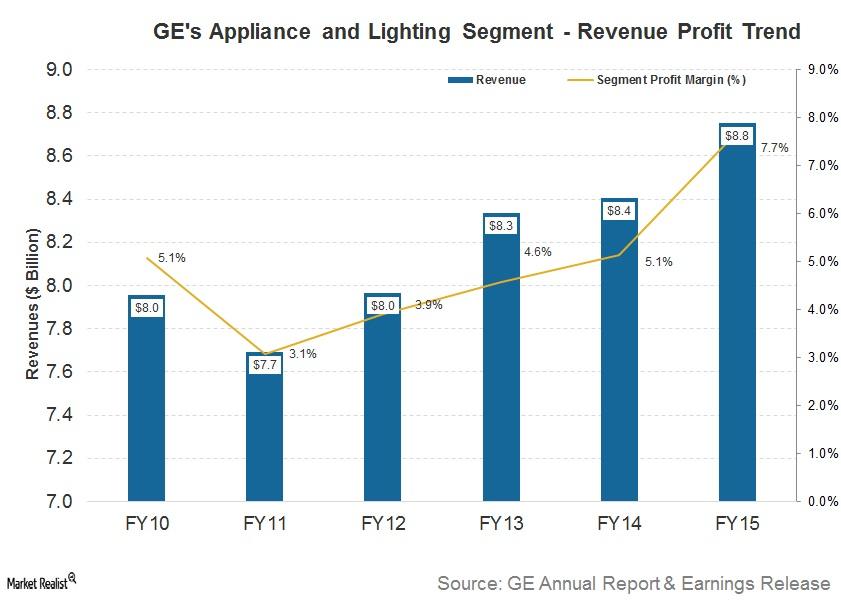

Why General Electric Sold Its Appliances Business to Haier

General Electric wants to shift away from the appliances business, as this segment doesn’t fit into its core business portfolio.

A Look at Analysts’ Top 5 US Steel Stocks

In this overview article, we’ll see how analysts are rating the leading steel stocks, and we’ll also compare performance from the top five steel companies.

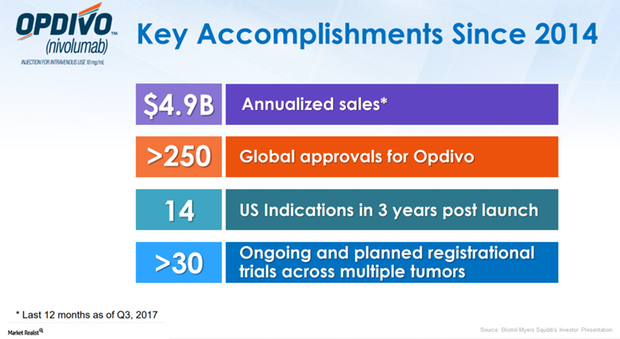

Opdivo Could Be Long-Term Growth Driver for Bristol-Myers Squibb

In 1Q17, 2Q17, and 3Q17, Opdivo reported revenues of $1.1 billion, $1.2 billion, and $1.3 billion, respectively.

These Factors Are Contributing to Gilead Sciences’ Weak Outlook

Gilead Sciences’ (GILD) revenue fell 7% and 13% in 2016 and 9M17, respectively. The fall was due to lower product sales. Both antiviral products and other products recorded declines in both the periods.

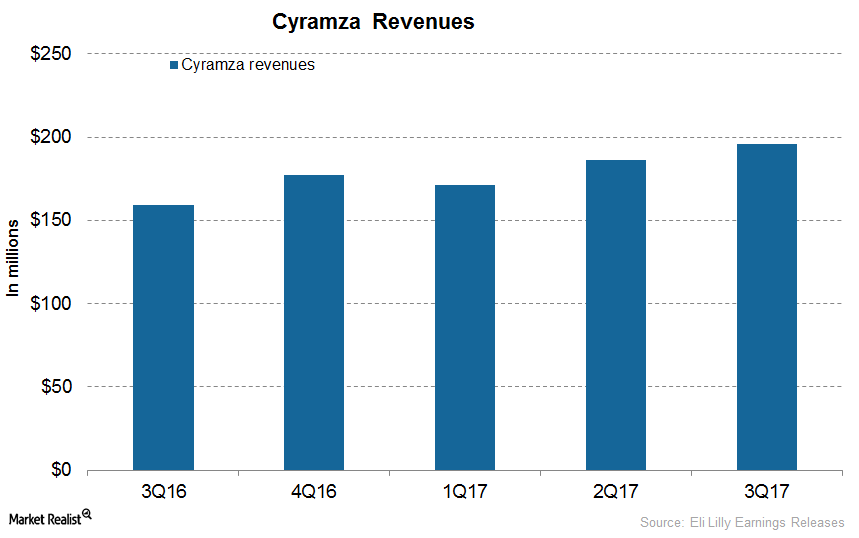

How Has Eli Lilly’s Cyramza Performed

In 3Q17, Eli Lilly’s (LLY) Cyramza generated revenues of $196 million, which reflected ~23% growth on a YoY basis and 5% growth on a quarter-over-quarter basis.

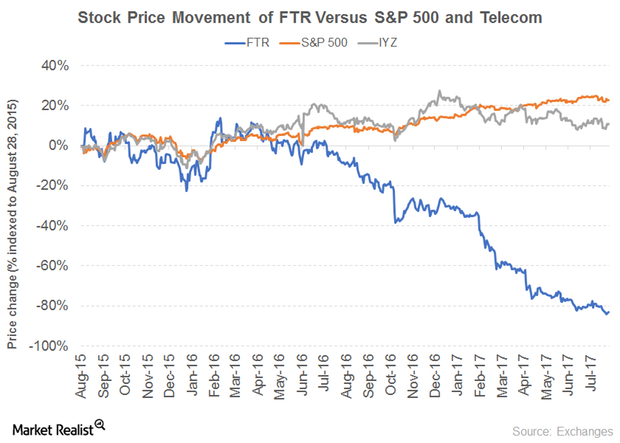

Frontier Communications: High Dividend Yield despite Dividend Cut

In this series, we’ll look some small-cap stocks with high dividend yields.

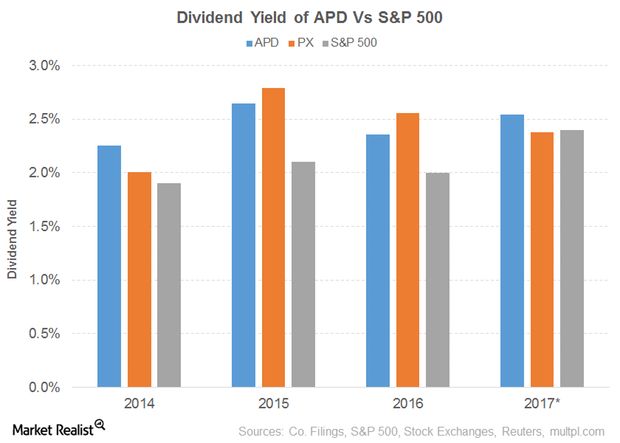

Dividend Yield of Air Products & Chemicals

In this series, we’ll be looking at ten dividend aristocrats with low PE ratios. Dividend aristocrats are S&P 500 stocks that have raised their dividend payouts for at least 25 successive years.

Analyzing the Dividend Curves of General Electric and Cisco Systems

General Electric’s (GE) revenue fell 7.0% in the first half of 2017, driven by its energy connections and lighting business.

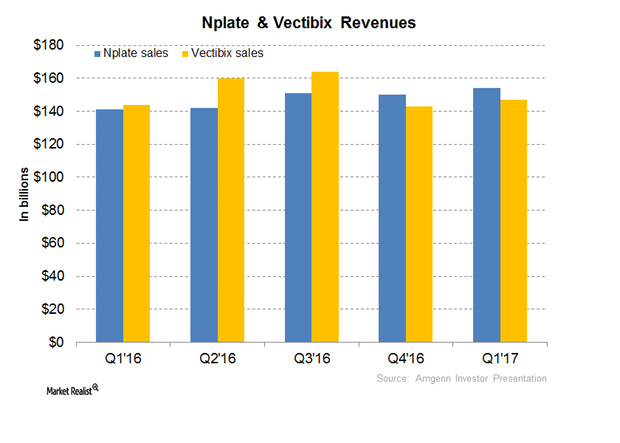

Nplate and Vectibix Could Contribute to Amgen’s Revenue Growth in 2017

In 1Q17, Amgen’s (AMGN) Nplate generated revenues of ~$154 million, which reflected a year-over-year growth rate of 9%.

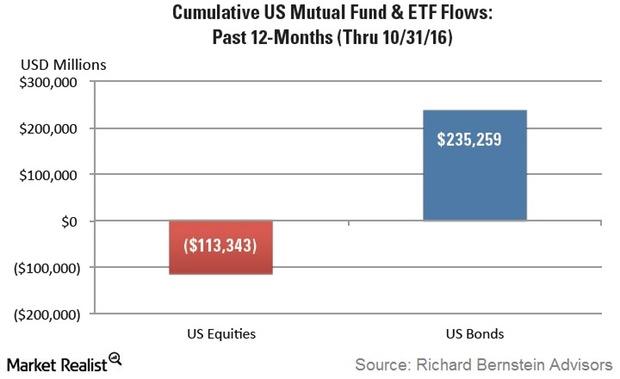

Bernstein: Excess Risk Aversion Has Made Investors ‘Wallflowers’

In his November Insights newsletter, Richard Bernstein stated, “It is incredible that investors have basically been wallflowers during the second longest bull market of the post-war period.”

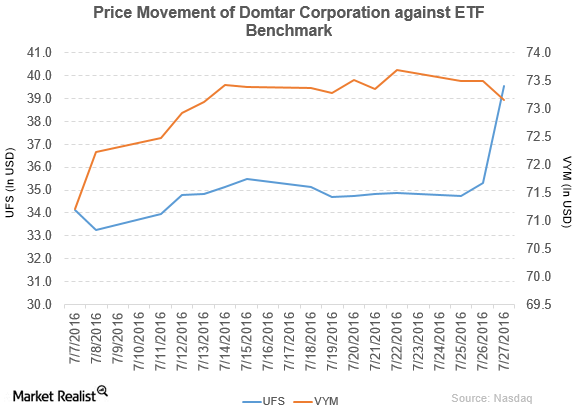

How Did Domtar Perform in 2Q16?

Domtar (UFS) has a market cap of $2.5 billion. It rose by 11.9% to close at $39.53 per share on July 27, 2016.Healthcare Must-know: 3 key risks in stock market investing

Know the market and know your own appetite for risk before investing. You can’t eliminate market risk, also called systematic risk, through diversification. You can, however, hedge against market risk.