TransCanada Corp

Latest TransCanada Corp News and Updates

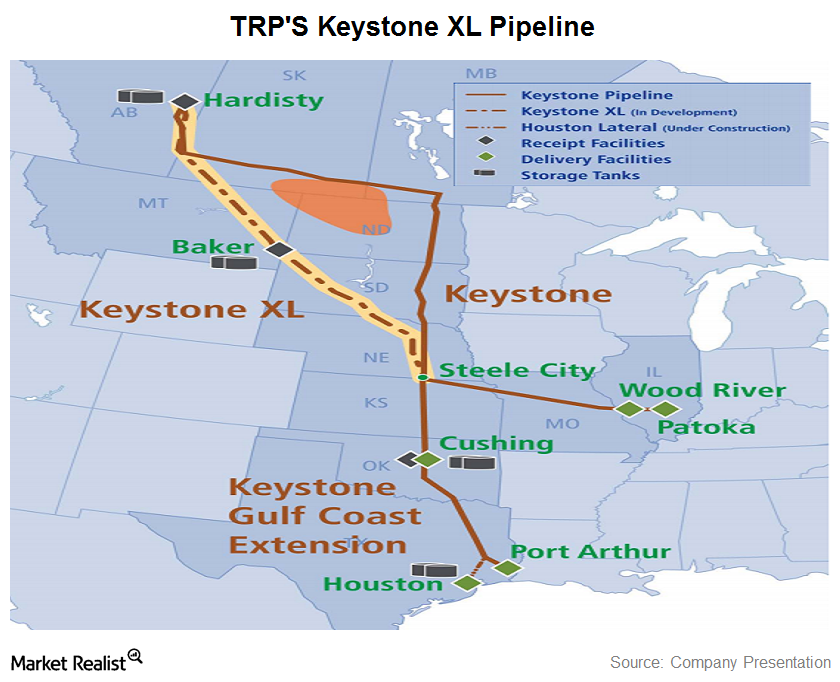

TransCanada’s controversial Keystone XL Pipeline project

The Keystone XL Pipeline project is a proposed 1,179-mile pipeline. It begins in Alberta, Canada and extends south to join the existing Keystone Pipeline in Steele City, Nebraska.

The story behind the Canadian giant—TransCanada Corp.

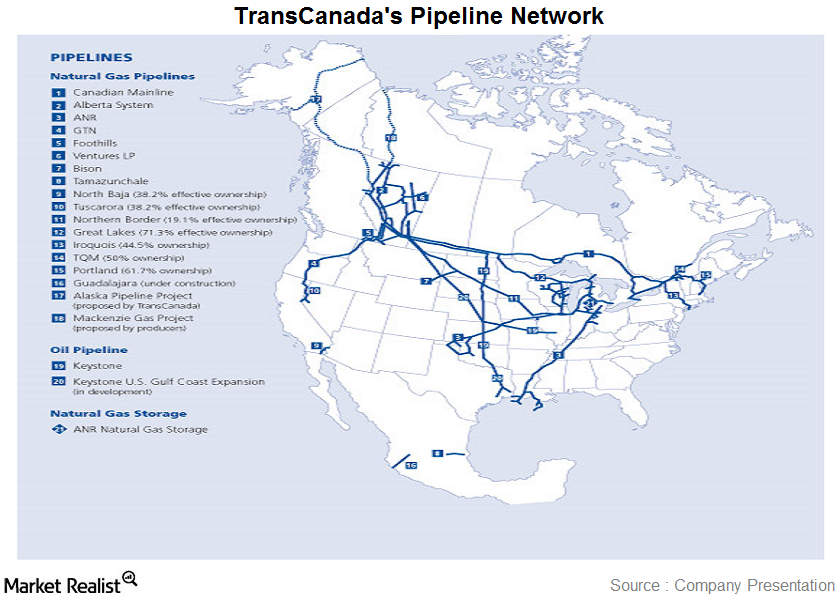

TransCanada Corporation (TRP) is based in Canada. It’s one of North America’s leading natural gas pipeline network owners. TransCanada also provides natural gas storage services.

Enbridge’s Line 3 Replacement Project Gets Delayed

On March 1, after the markets closed, Enbridge announced that it received a timeline for the permits for its Line 3 Replacement project.

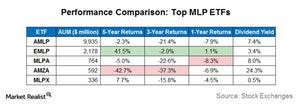

EMLP Generated the Highest Total Returns among the Top MLP ETFs

The First Trust North American Energy Infrastructure Fund (EMLP) generated total returns of 42% over a five-year period, the highest among the top five MLP ETFs that we are discussing in this series.

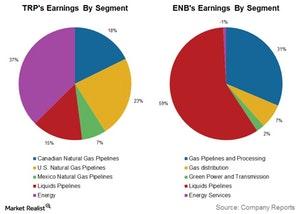

Enbridge and TransCanada’s Business Segments

With the completion of the merger with Spectra Energy in February 2017, Enbridge’s business mix has become more diversified.

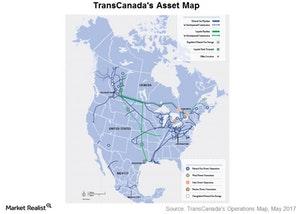

TransCanada: An Overview of Assets and Operations

TransCanada (TRP) was founded more than 65 years ago, and its operations spread across seven Canadian provinces, 38 US states, and Mexico.