ProShares UltraShort 20+ Year Treasury

Latest ProShares UltraShort 20+ Year Treasury News and Updates

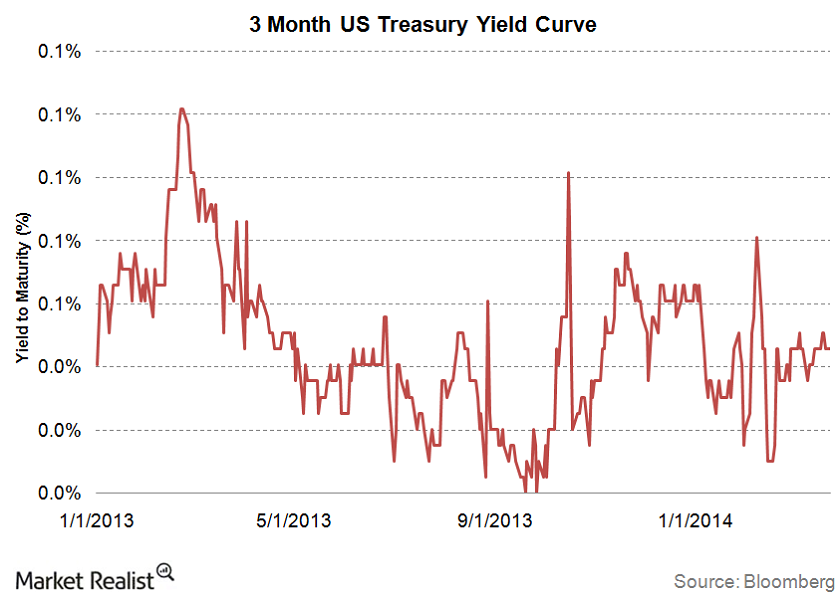

Financials Why the yield curve impacts bank profitability

Historically, a flatter yield curve had an adverse impact on the financial institutions’ returns. It lowered their net interest margins. The Fed continues to stress an accommodative monetary policy. The policy and strong overseas demand have kept yields low at the long end of the curve. As a result, the difference between 30-year and five-year Treasury yields fell to 154 basis points on September 5, 2014.

Knowing the Treasury discount rate and yields before investing

Investors can take an informed decision by knowing the rate of return on their investment.

Gundlach Discussed the Fed, Trade Deal, and Gold

Gundlach thinks that we’ve already seen a bottom in interest rates for 2019. US Treasury yields have been hitting lows in 2019.

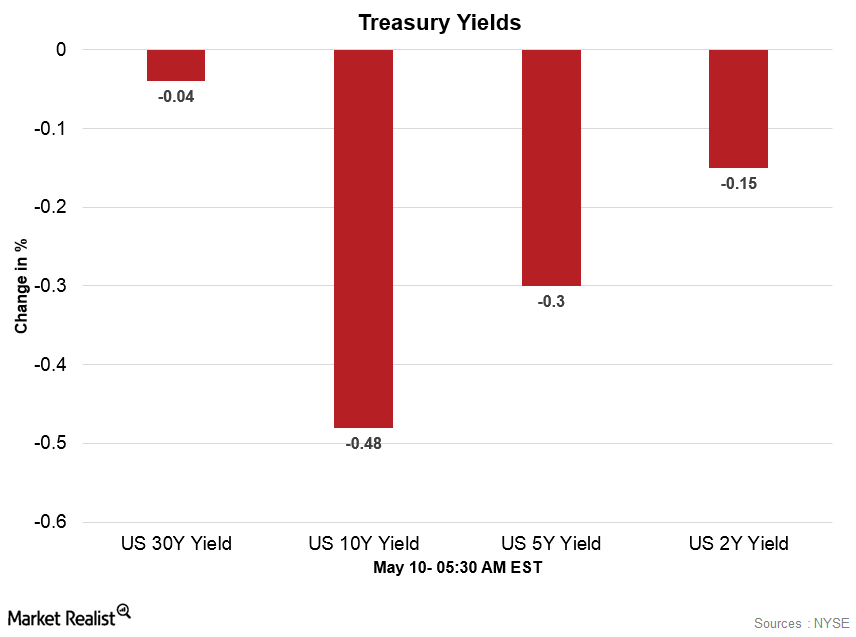

US Dollar Index and Treasury Yields in the Early Hours

The US Dollar Index started Thursday on a mixed note and traded with weakness in the early hours.

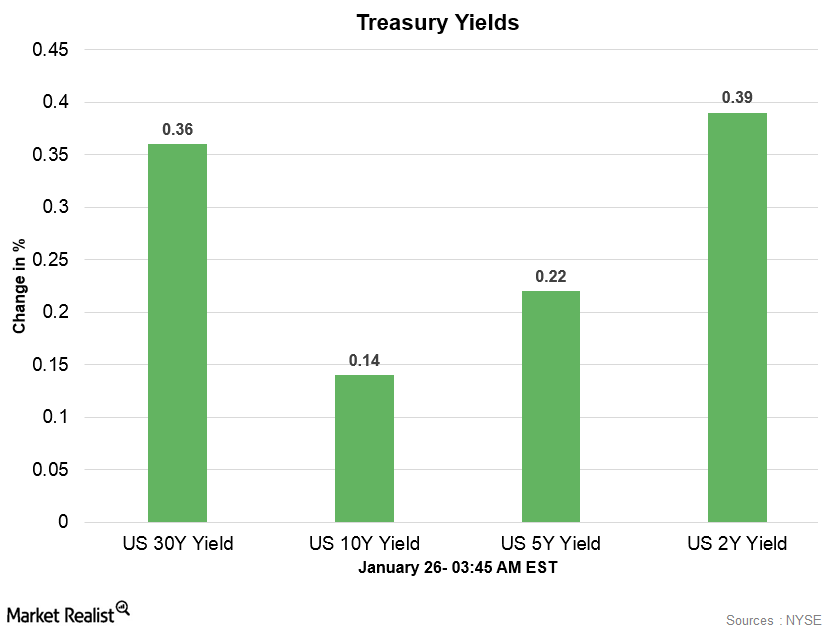

US Dollar Index and Treasury Yields Early on January 26

The US Dollar Index started this week on a weaker note. At 3:35 AM EST on January 26, the US Dollar Index was trading at 88.83—a drop of 0.62%.

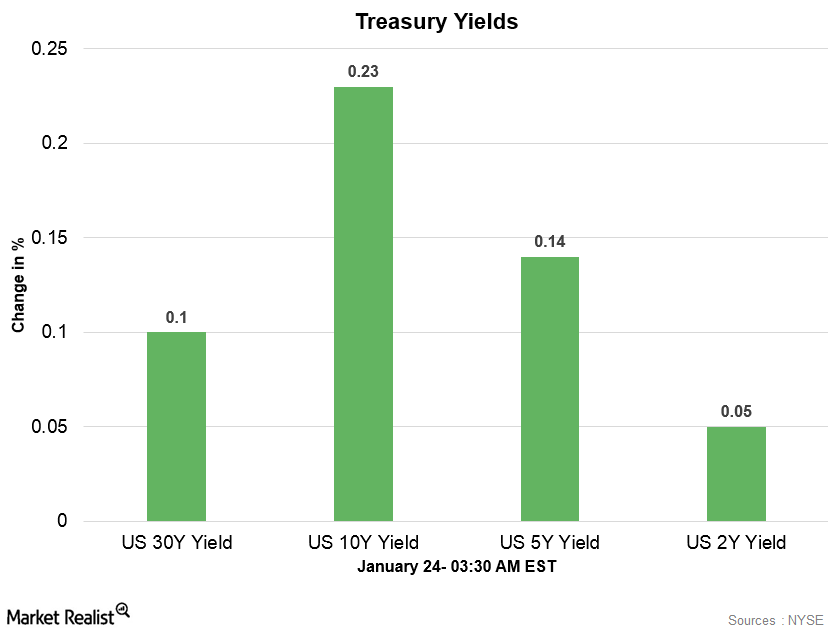

US Dollar Index and Treasury Yields Are Mixed in the Early Hours

On January 24, 2018, the US Dollar Index opened the day lower and traded at fresh three-year low price levels in the early hours.

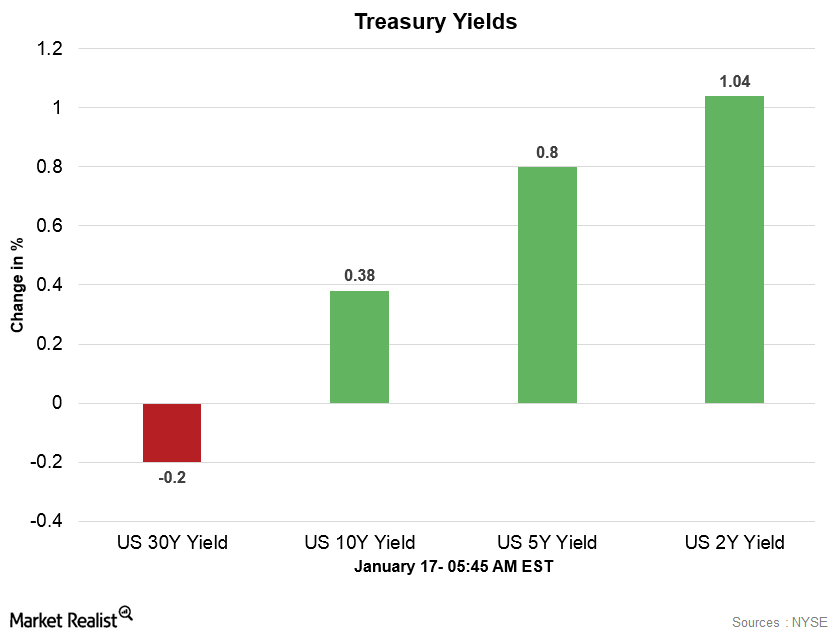

US Dollar Index and Treasury Yields on January 17

The US Dollar Index is trading above opening prices with stability. At 5:30 AM EST on January 17, the US Dollar Index was trading at 90.6.

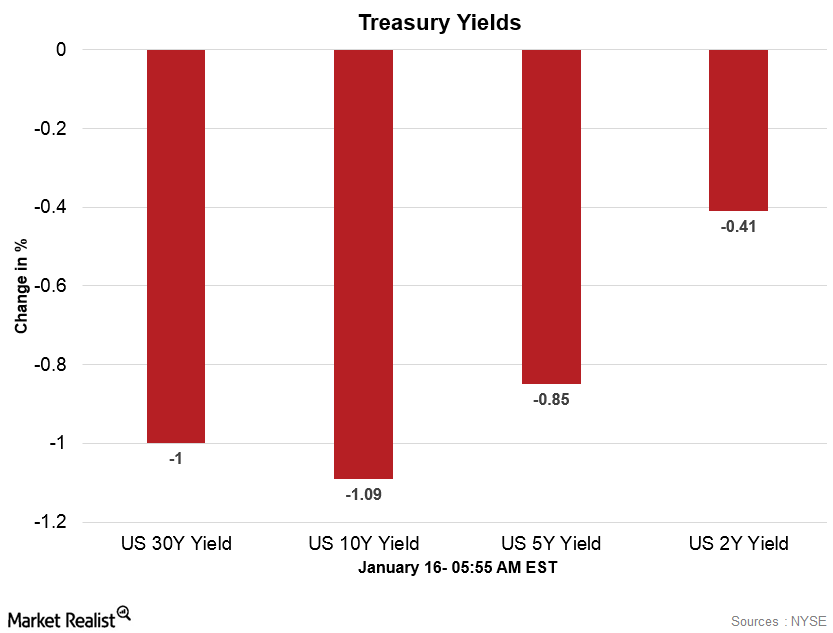

US Dollar Index Regained Strength Early on January 16

After falling for four consecutive trading weeks, the US Dollar Index started this week on a weaker note by falling to three-year low price levels.

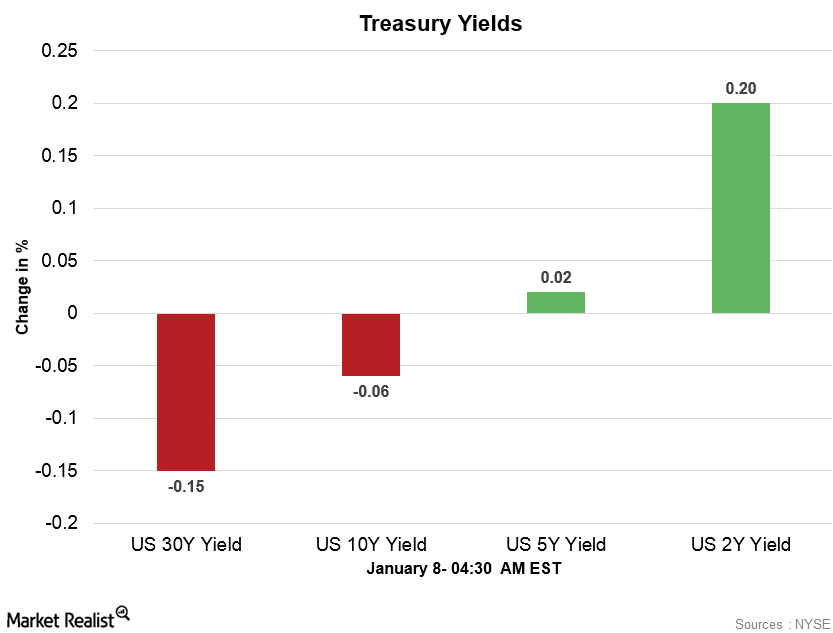

US Dollar Index and Treasury Yields Early on January 8

The US Dollar Index opened January 8 on a stronger note and traded at one-week high price levels in the early hours.

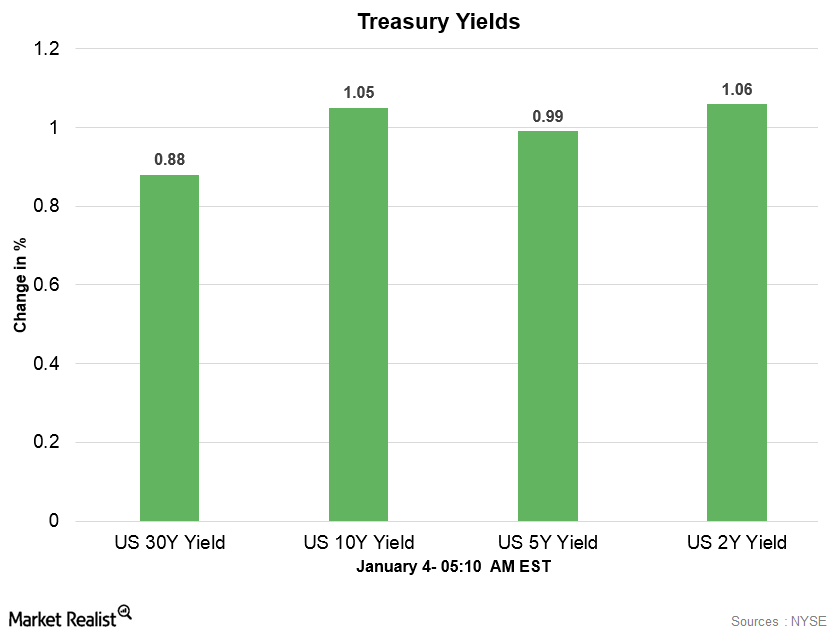

US Dollar Index and Treasury Yields Early on January 4

After falling for two consecutive trading weeks, the US Dollar Index started this week on a weaker note and traded with mixed sentiment.

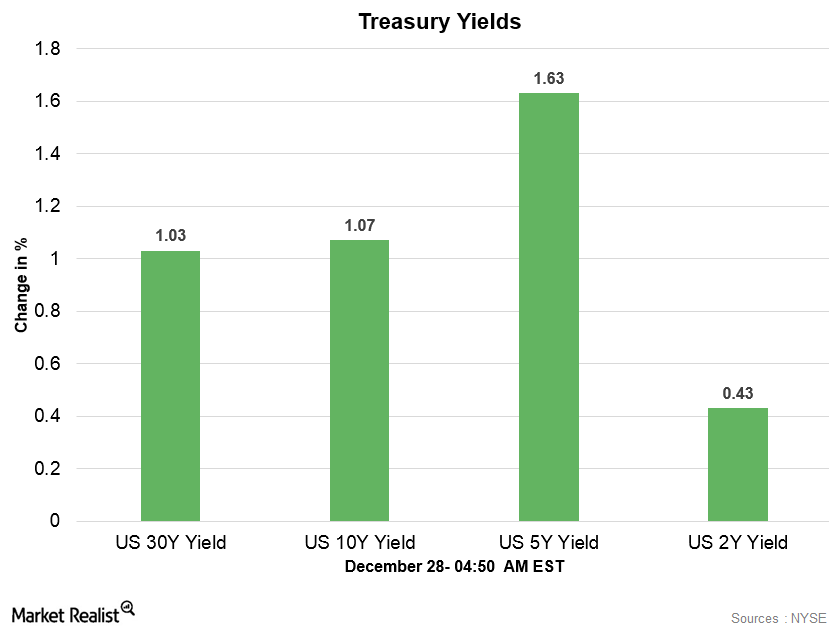

How the US Dollar Index and Treasury Yields Performed on December 28

The US Dollar Index broke its three-week-long gaining steak this week and fell to three-week low price levels on Wednesday.

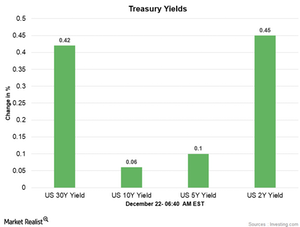

US Dollar Index and Treasury Yields Are Stable in the Early Hours

After gaining for three trading weeks, the US Dollar Index started this week on a weaker note and fell in the first four trading days of the week.

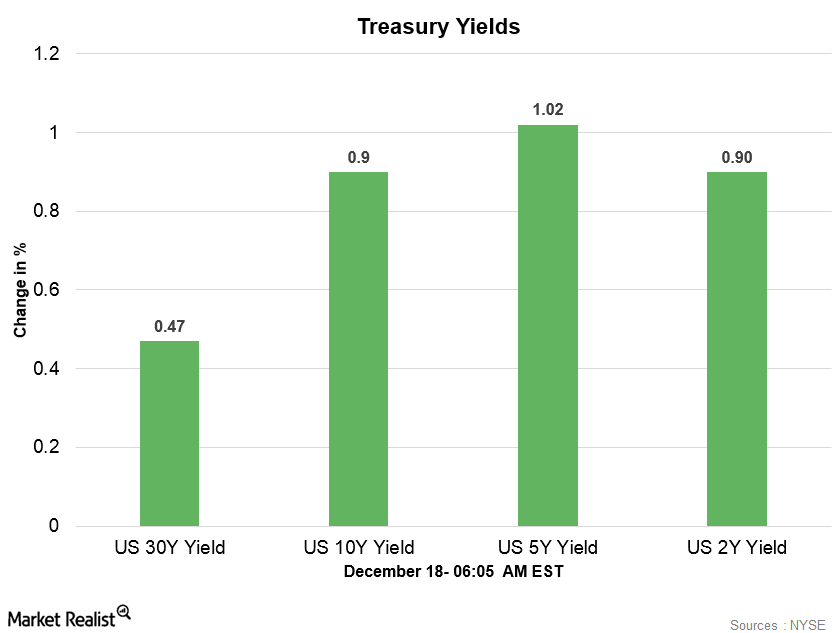

US Dollar Index and Treasury Yields Rose in the Early Hours

After gaining for three consecutive trading weeks, the US Dollar Index started this week on a mixed note.

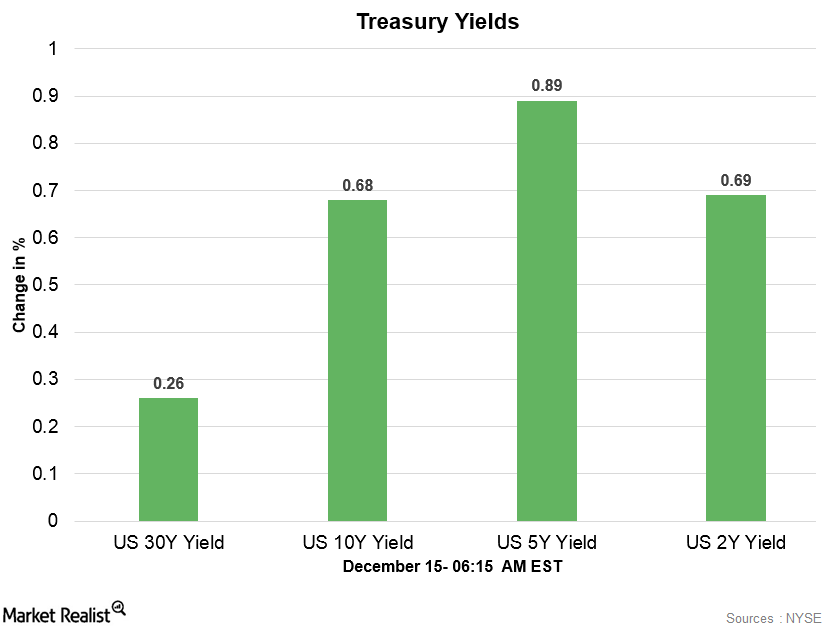

US Dollar Index is Weak in the Early Hours on December 15

The US Dollar Index traded with strength for two weeks and started this week on a mixed note amid the dented market sentiment.

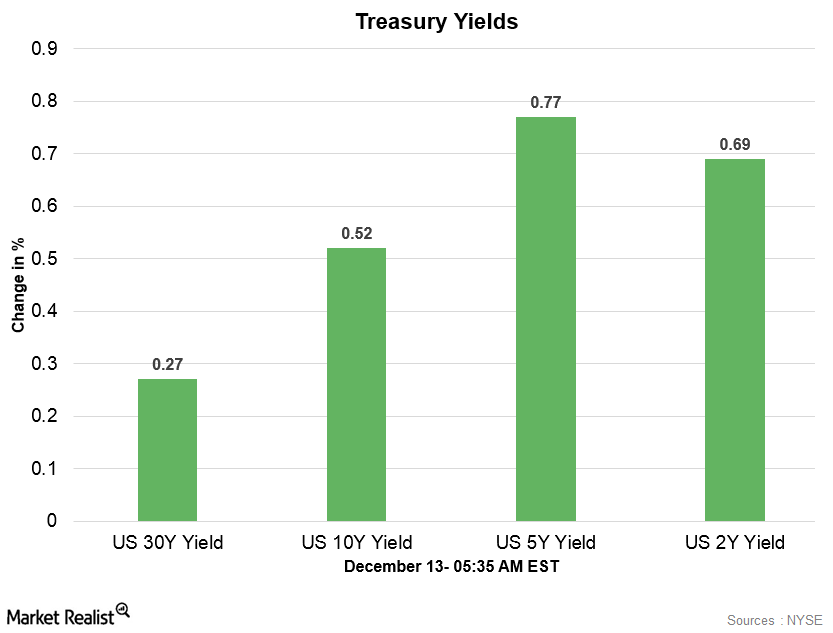

US Dollar Index Is Weak Early on December 13

In the early hours on Wednesday, the US Dollar Index is weak and trading below the opening prices. At 3:50 AM EST, it was trading at 94—a fall of 0.11%.

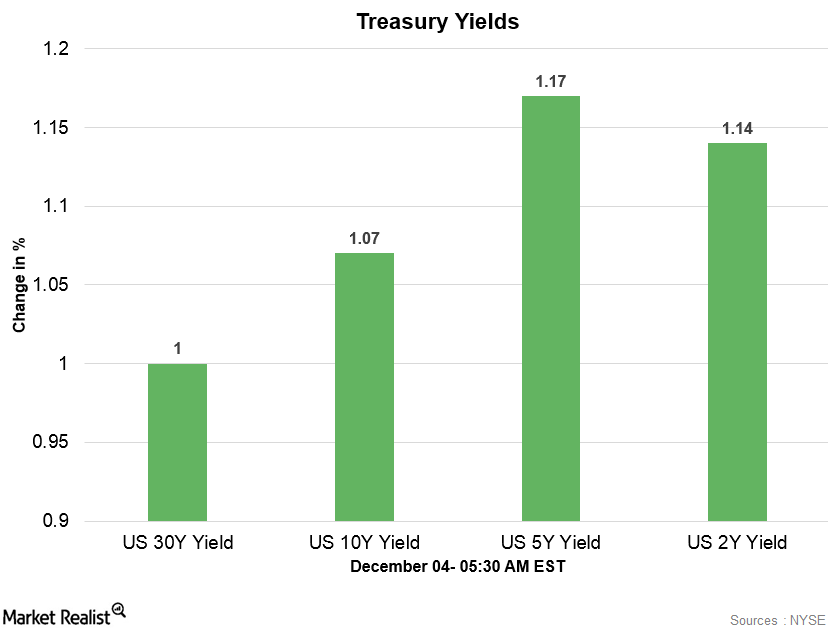

US Dollar Index and Treasury Yields Are Stable

The US Dollar Index started this week on a stronger note by rebounding on Monday. The US Dollar Index opened Tuesday on a stable note.

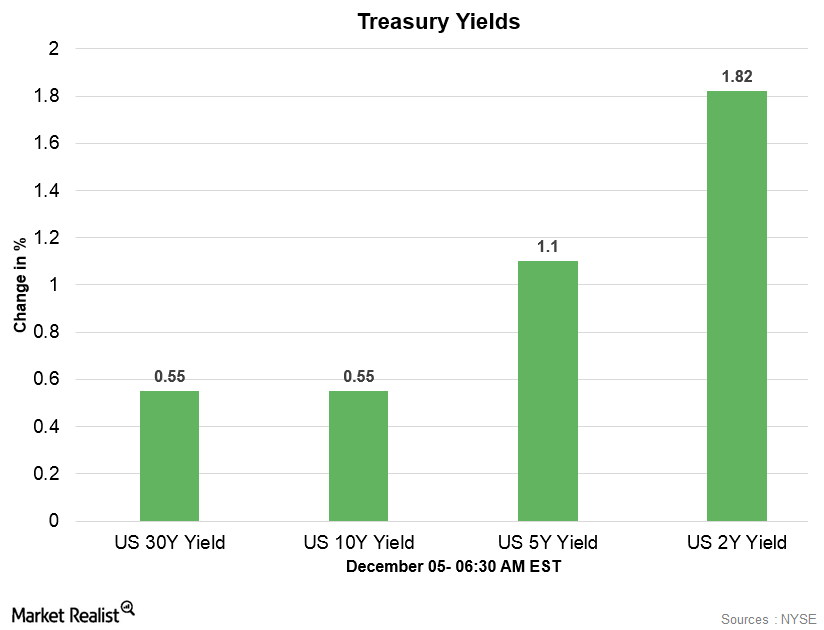

US Dollar Index and Treasury Yields Are Strong

The US Dollar Index broke its three-week losing streak last week and regained stability. The US Dollar Index opened higher on Monday.

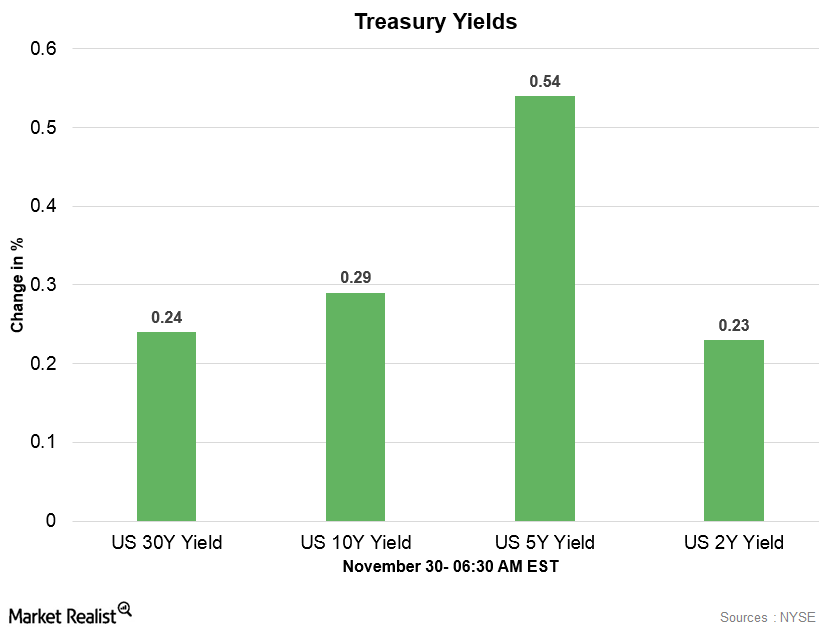

US Dollar Index and Treasury Yields Are Strong on November 30

In the early hours on November 30, the US Dollar Index is trading with strength above opening prices.

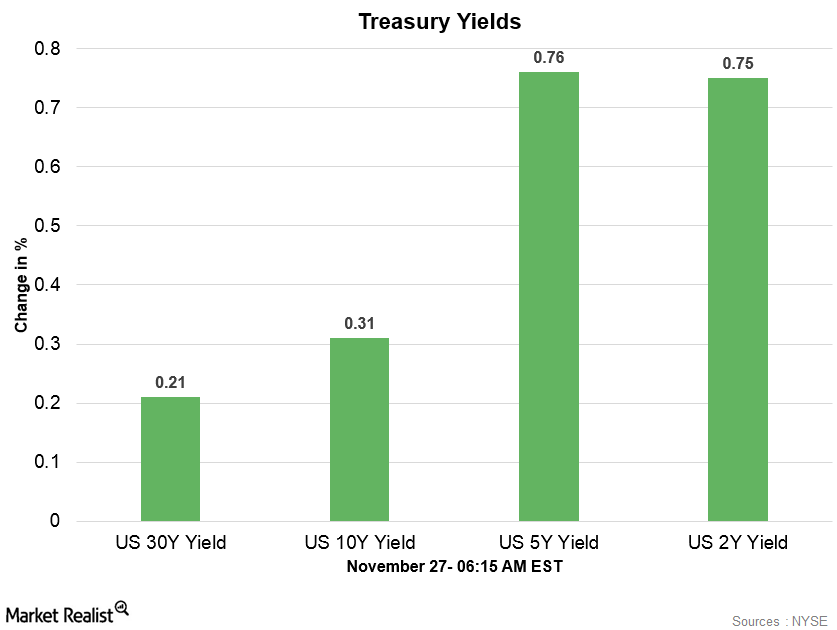

US Dollar Index Is Weak in the Early Hours on November 27

The US Dollar Index started this week on a weaker note and traded below the opening prices in the early hours on Monday.

US Dollar Index Weak in The Early Hours of November 23

US Dollar Index The US Dollar Index has been weak for two consecutive trading weeks, and started this week on a mixed note. The index lost strength as the week progressed and fell to four-week lows on Wednesday. The US Dollar Index opened the day with weakness on Thursday. Market sentiment Market sentiment towards the US Dollar Index was […]

US Dollar Index Consolidates in the Early Hours

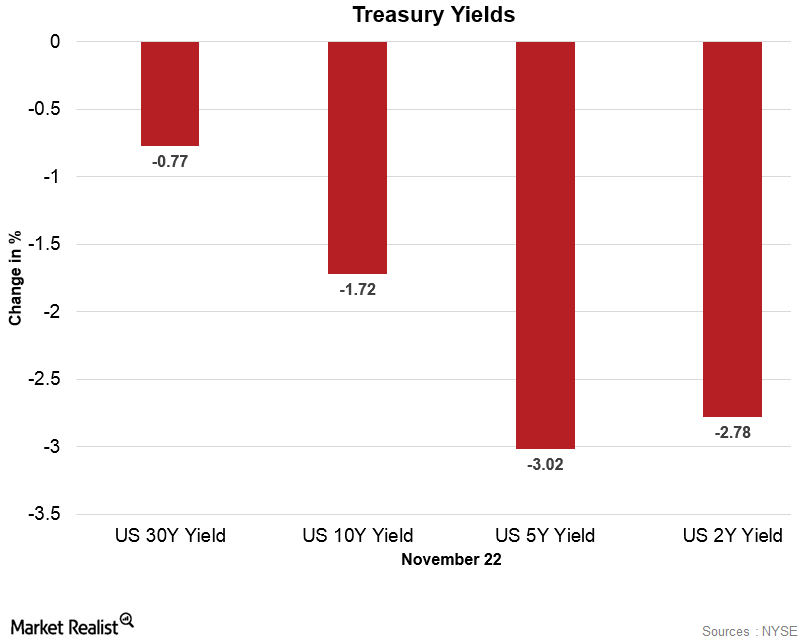

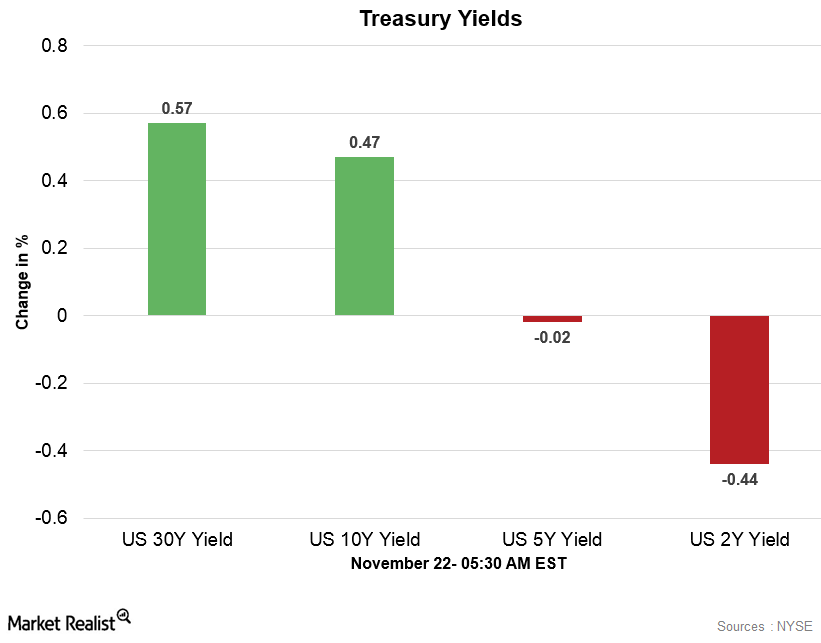

In the early hours on November 22, the US Dollar Index is trading with weakness below the opening prices.

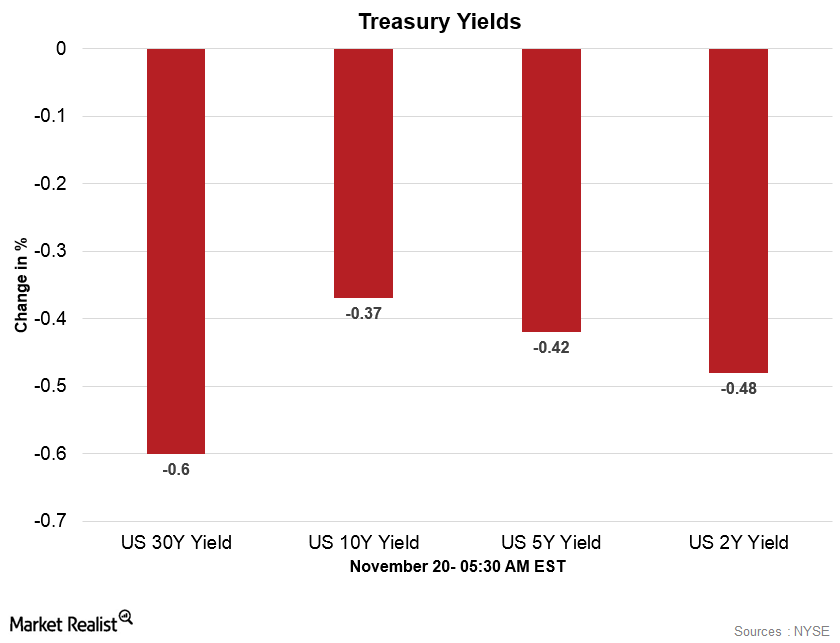

US Dollar Index is Stable in the Early Hours on November 20

The US Dollar Index opened on a stronger note on November 20. However, the dollar lost strength as the day progressed.

US Dollar Index Is Weak in the Early Hours on November 17

The US Dollar Index started Friday on a weaker note and traded below the opening prices with weakness in the morning session.

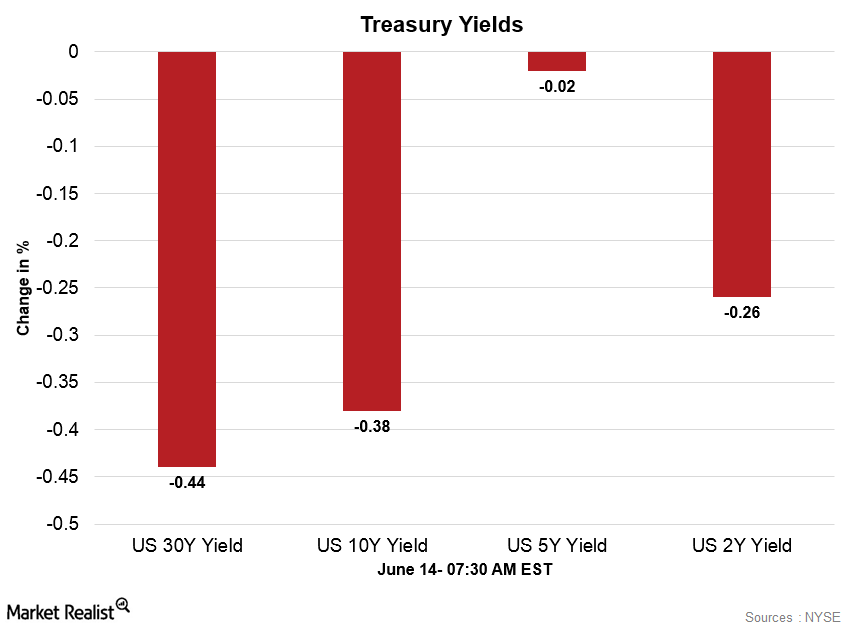

US Dollar and US Treasuries Are Slightly Weaker

In the early hours on Wednesday, the US Dollar Index is slightly weaker. At 5:45 AM EST on June 14, the US Dollar Index was trading at 96.99—0.01% higher.

Should You Short European Bonds due to Taper Talks?

Like their equity peers, bonds can be short-sold as well. You can do it by either shorting an ETF or investing in an inverse ETF.