Global X Silver Miners ETF

Latest Global X Silver Miners ETF News and Updates

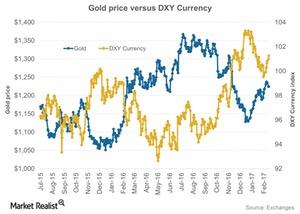

Why Gold and the US Dollar Are Moving in Opposite Directions

Gold prices tumbled on Tuesday, February 14, as the US dollar rose after the US Federal Reserve chair, Janet Yellen, seemed optimistic about raising interest rates.

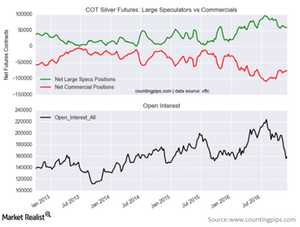

Commercial and Non-Commercial Positions in Silver Are Falling

Silver-based mining funds like the Global X Silver Miners Fund (SIL) have been negatively impacted by the drop in silver prices.

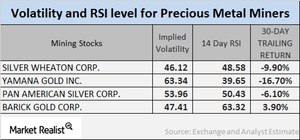

What Do Mining Stocks’ Technicals Indicate?

Many of the fluctuations in precious metals have been a result of speculation about the Federal Reserve’s interest rate stance.

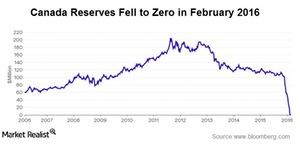

Why Canada Cut Its Gold Reserves

Canada is the only G7 nation that does not hold at least 100 tons of gold in its reserves. Its holdings rank it last of 100 central banks—behind Albania.

What Do Analysts Think about Coeur Mining?

Of the ten analysts covering Coeur Mining, 50% have given the stock a “buy” recommendation. The average target price is $14.20 compared to its current price of $15.90.

What Global Factors Are Affecting Silver?

Silver surged ~30% during the first few months of the year. However, the increased fear that the Federal Reserve will hike the interest rate pushed the precious metals lower.