Rosetta Resources Inc

Latest Rosetta Resources Inc News and Updates

How does the production cost of crude oil affect oil prices?

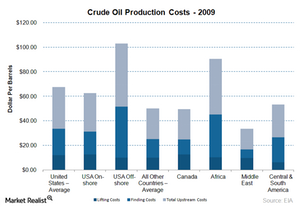

Recent consensus says the production cost of crude oil could range from $20 to $25 per barrel.

Why the bottom fell out of crude oil

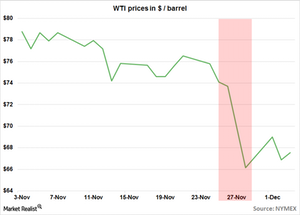

Oil markets had been watching what OPEC would do in its November 27 meeting. Crude oil fell ~30% since June. It decided to stay production levels. Crude oil dropped ~10% after the news.