RPC Inc

Latest RPC Inc News and Updates

The Top 5 Oilfield Companies by Net Debt-To-Equity Ratio

In this series, we’ll analyze the top five OFS (oilfield equipment and service) companies by net debt-to-equity ratio in fiscal 2017.

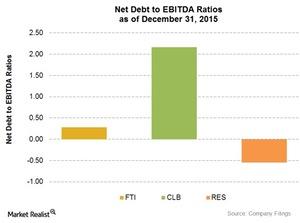

Analyzing the Net-Debt-to-EBITDA Ratios of 4 Major Mid-Cap OFS Companies

In fiscal 2015, RPC’s (RES) net-debt-to-EBITDA ratio stood at -0.54, down from the 0.34 it saw in 2014. The company’s long-term debt stood at zero in 2015.