Qunar Cayman Islands Ltd

Latest Qunar Cayman Islands Ltd News and Updates

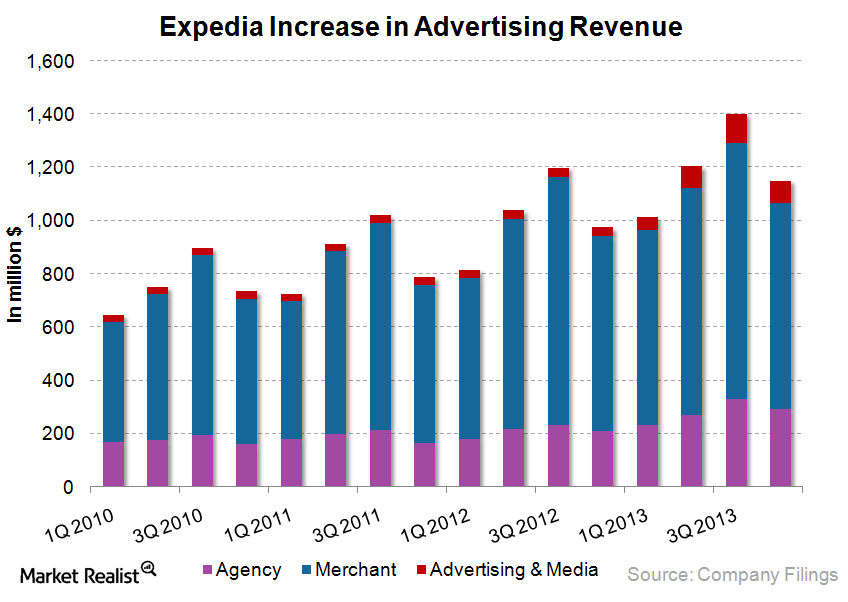

Expedia’s trivago acquisition raises advertising revenue growth

Officially launched in 2005, Expedia’s trivago is a known travel brand in Europe and continues to operate independently, and grow revenue via global expansion.

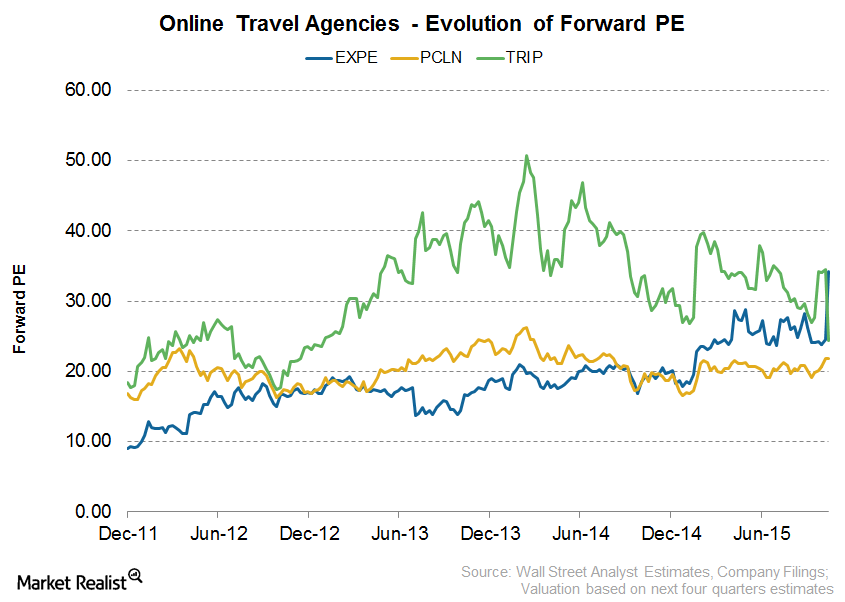

Valuation: Priceline Versus Its Peers

As of November 6, 2015, Priceline’s forward PE ratio stood at 21.8x, and its average valuation stands at 20x.

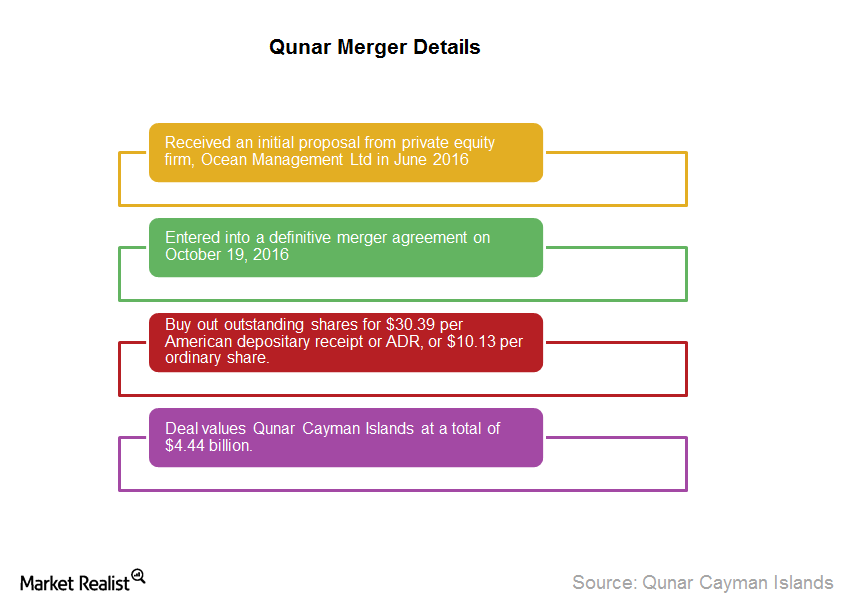

Qunar Is Going Private: How Does It Affect Investors?

In June 2016, Qunar (QUNR) received an initial proposal from private equity firm Ocean Management.

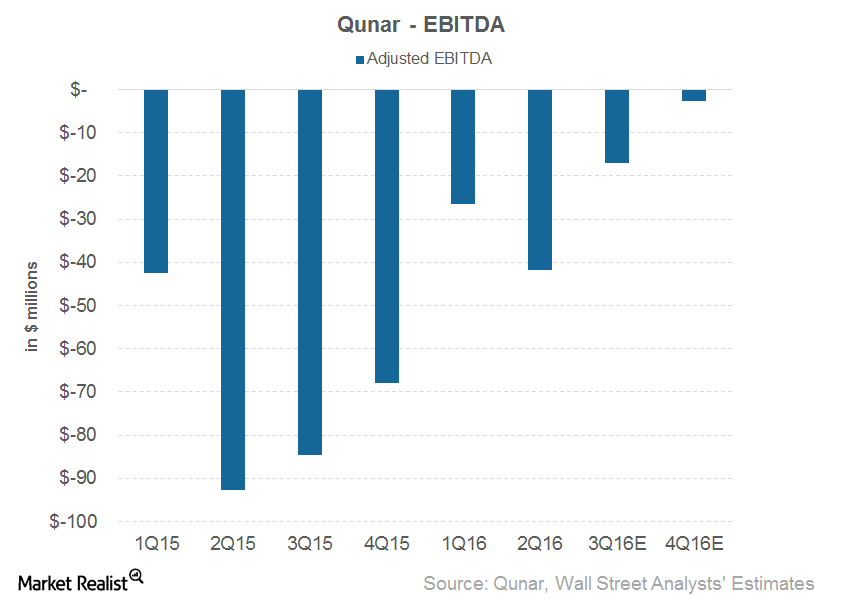

Why Isn’t Qunar Profitable Yet?

Analysts are estimating that Qunar Cayman Islands (QUNR) will incur an EBITDA loss of $17 million in 3Q16 and $3 million in 4Q16.

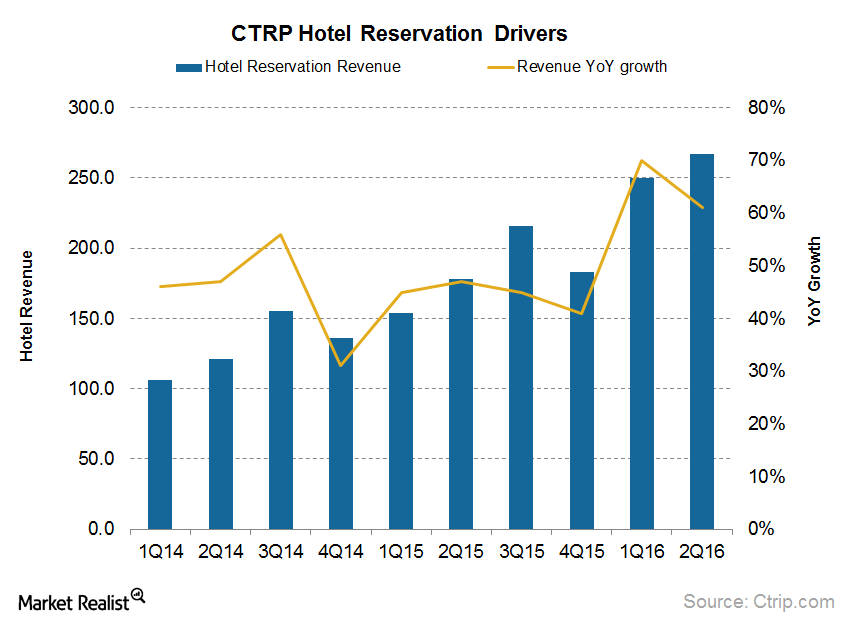

These Segments Will Contribute the Most to Ctrip’s Future Growth

At 39% in 2Q16, hotels formed a significant part of Ctrip’s revenue, much like other OTA (online travel agency) players.