PowerShares DWA Healthcare Momentum ETF

Latest PowerShares DWA Healthcare Momentum ETF News and Updates

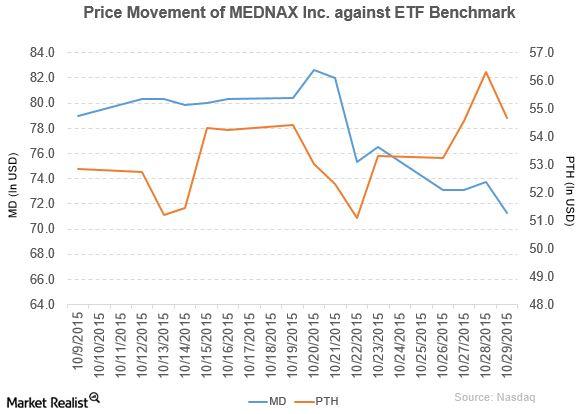

MEDNAX Revenue and Income Rose After 3Q15 Results

MEDNAX’s YTD price movement was a mix of rises and falls in 2015. After the earnings report, MEDNAX fell 3.4% to close at $71.3 per share as of October 29, 2015.

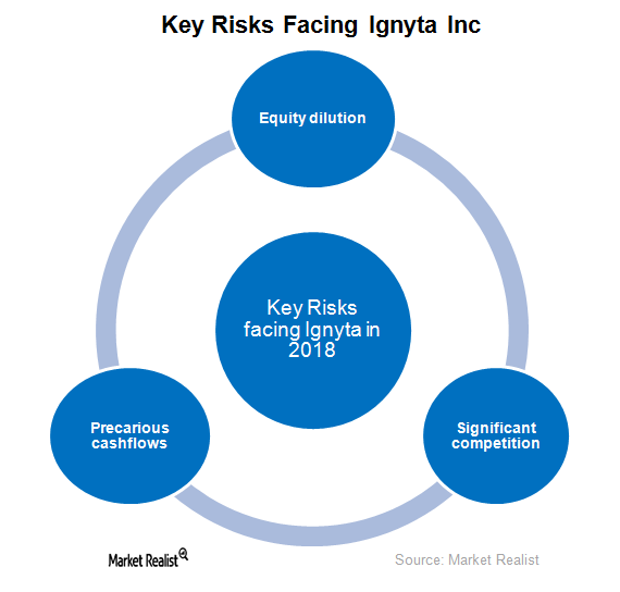

Ignyta and Its Key Risks in 2018

In October 2017, Ignyta (RXDX) raised $150 million by issuing 10 million shares of its common stock.

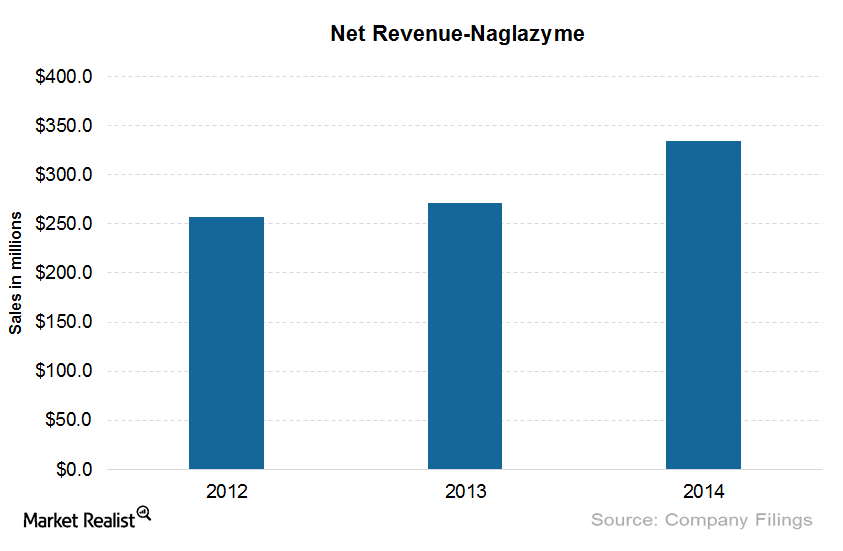

Naglazyme: One of the Costliest Drugs in the United States

The wholesale cost per patient for Naglazyme is around $485,747 per year. The drug has been effective in improving walking and stair-climbing capacity.