POSCO

Latest POSCO News and Updates

Financials Must-know: Why did the Indian rupee free-fall in 2013?

India’s current account deficit rose to 4.8% of GDP in 2012–2013, largely financed through hot money flows, and exceeded the government’s target level of 2.5% to 3% of GDP.

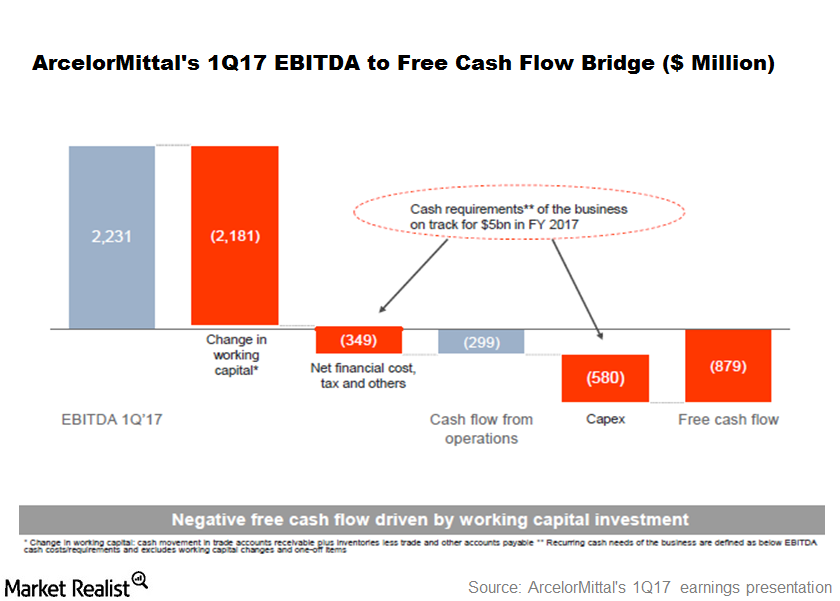

Why Investors Shouldn’t Fret over MT’s Negative Free Cash Flow

In this article, we’ll look at ArcelorMittal’s 1Q17 cash flow and leverage positions. As of the end of 1Q17, ArcelorMittal had net debt of $12.1 billion.

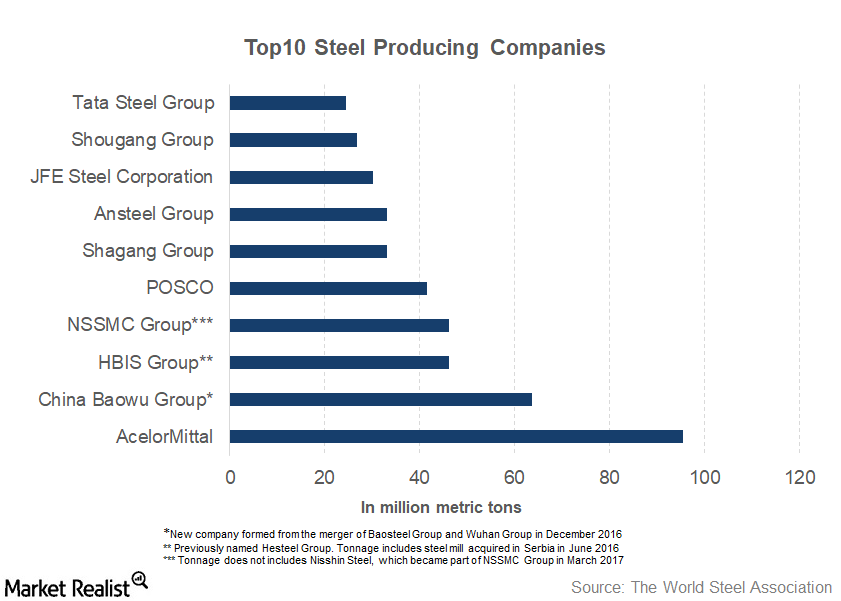

Size Matters: Which Are the Top 10 Steel-Producing Companies?

In this series, we’ll look at the top ten companies in the global steel industry based on steel production, steel consumption, and steel imports.