Public Service Enterprise Group Inc

Latest Public Service Enterprise Group Inc News and Updates

Energy & Utilities Must-know: Who owns Dominion?

Institutional investors hold most of Dominion Resources’ (D) outstanding shares. As of June 30, 2014, a total of 351.2 million shares were held by 1,069 institutions.Energy & Utilities Why electricity demand is linked to GDP

Electricity is the backbone of a nation’s progress. All of the industries need electricity to operate—directly or indirectly. When a business flourishes, the electricity consumption increases.

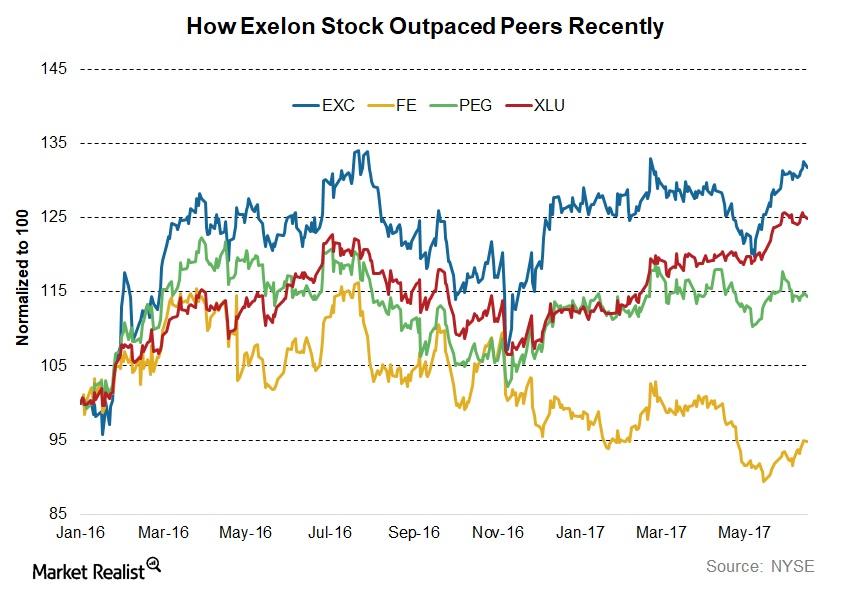

EXC, FE, and PEG: Are Hybrid Utilities Really Worth the Risk?

US utilities including giants like Duke Energy (DUK) and Southern Company (SO) have done fairly well in the last few months compared to broader markets.

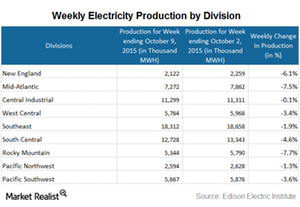

Electricity Generation Falls in All Census Divisions

the electricity generation in the US fell by 3.5% to 71.1 million mWh. Electricity generation fell in all of the nine census divisions during the week ended October 9.