SPDR Russell 1000 Momentum ETF

Latest SPDR Russell 1000 Momentum ETF News and Updates

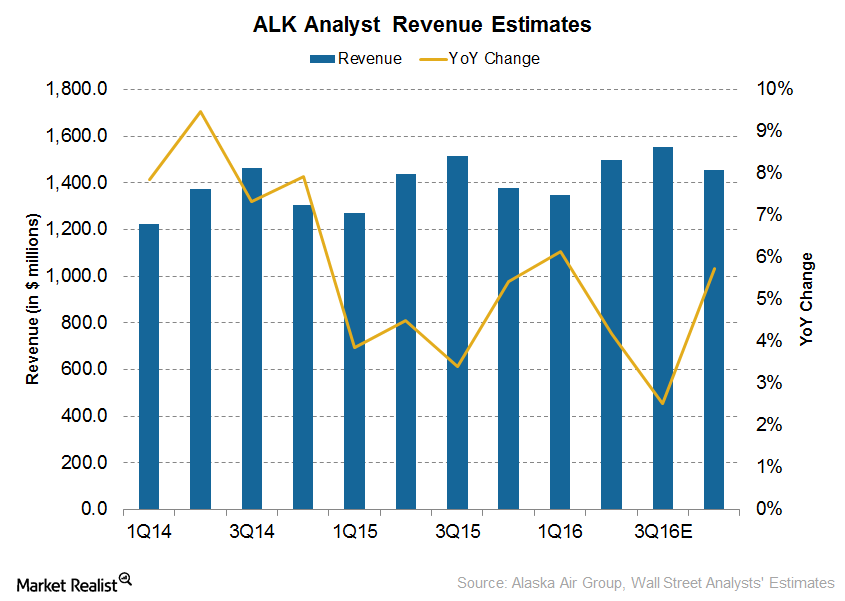

Alaska Air: Why Analysts Forecast Higher Revenue in Next 2 Years

For 2Q16, analysts are estimating 4.2% revenue growth for Alaska Air Group (ALK), which is slower than the 6.2% growth in 1Q16.

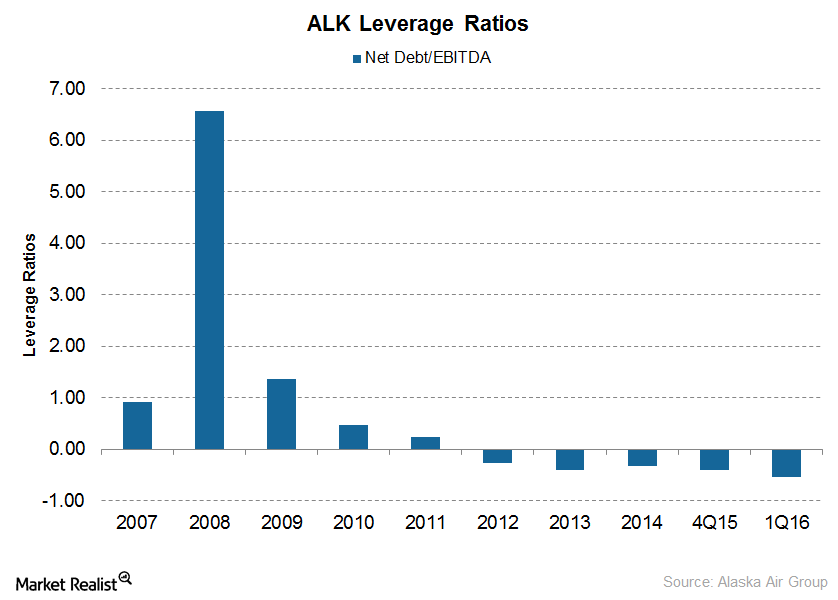

Alaska Air’s Low Debt: Is It an Advantage?

Alaska Air Group (ALK) has been trying to reduce its debt burden in order to strengthen its balance sheet in the long term.