Oaktree Capital Group LLC

Latest Oaktree Capital Group LLC News and Updates

Alvotech SPAC Is Coming—Might Be a Good Investment, Just Not Yet

Biosimilars brand Alvotech is merging with a blank-check firm to go public. Here's what to know about the stock, including whether it's a good investment.

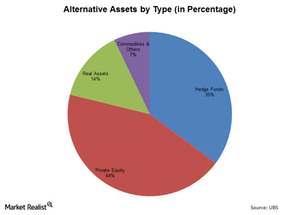

The relative share of the alternative asset management space

Alternative assets account for about 10% of the total global asset management industry that’s valued at $63.9 trillion. Private equity contributes most.