Nissan Motor Co., Ltd.

Latest Nissan Motor Co., Ltd. News and Updates

Can Renault’s Bigger Electric Car Take Tesla Head-On?

Bloomberg reported on October 8 that Renault (RNLSY) was mulling a new all-electric car. It’s expected to be bigger than its best-selling Zoe.

Ford and GM Split Over Siding with Trump

Automakers have effectively split in their support of a particular set of emission regulations, pitting large automakers Ford and GM against one another.

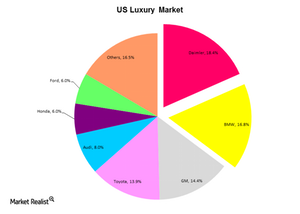

Daimler and BMW dominate the luxury car segment

German automakers lead the luxury space in the US. Daimler AG had an 18.4% share. It was followed by BMW. It had a 16.8% share.