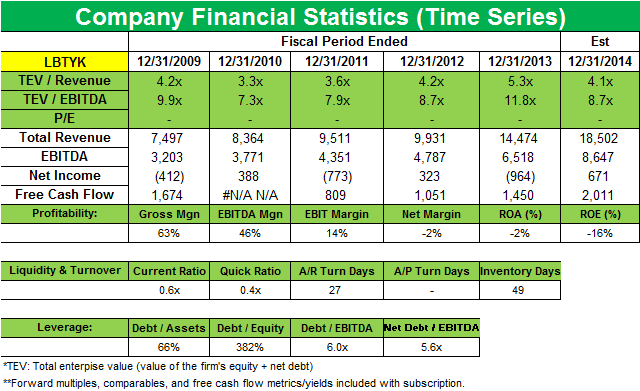

Liberty Global PLC

Latest Liberty Global PLC News and Updates

Warren Buffett’s Berkshire Hathaway ups its Liberty Global stake

Berkshire Hathaway added to its position in Liberty Global PLC (LBTYK) last quarter. The position now accounts for 0.57% of Berkshire’s 1Q 2014 portfolio, up from 0.25% last quarter.Consumer Berkshire Hathaway buys a new stake in Verizon Communications

Berkshire Hathaway took a new position in Verizon Communications (VZ) last quarter. The position accounts for 2.04% of the fund’s portfolio.

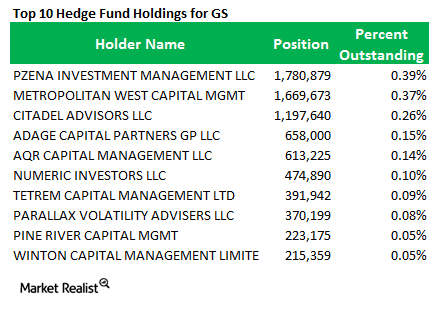

Berkshire Hathaway reveals a new position in Goldman Sachs

Berkshire Hathaway opened a brand new position in Goldman Sachs that accounts for 2.14% of the investment company’s $104 billion portfolio.