VanEck Vectors EMInvGrd+BBR USD SovBdETF

Latest VanEck Vectors EMInvGrd+BBR USD SovBdETF News and Updates

Inclusion of Chinese Onshore Bonds in Global Indexes

In March 2017, Citi’s fixed income indexes decided to include onshore Chinese bonds (EMB) (PCY) in its three government bond indexes.

How Did Emerging Market Debt Perform in 2016?

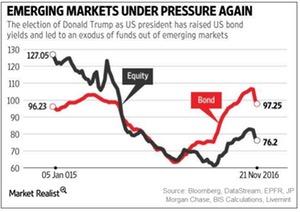

In the emerging market bond space (PCY) (EMLC), high-yield bonds and local currency bonds outperformed hard currency sovereign bonds.

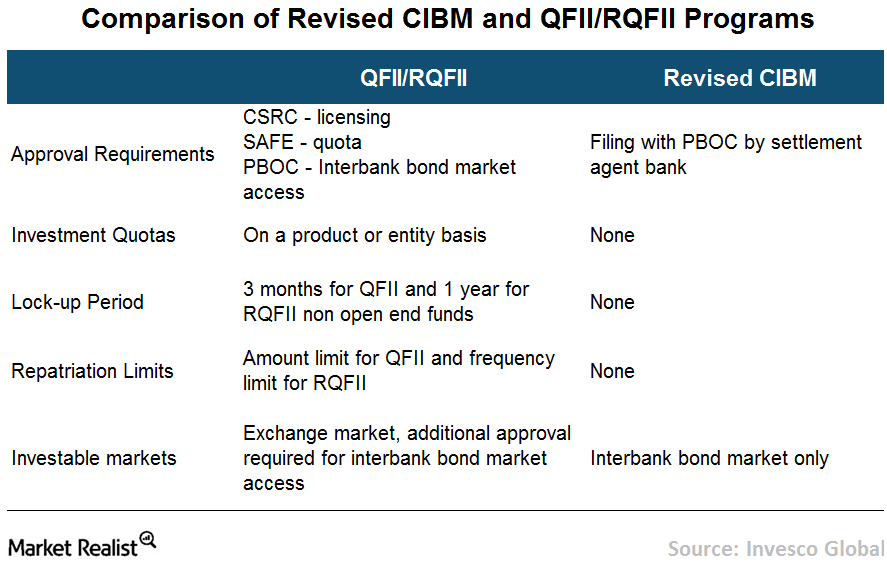

China’s Baby Steps to Open Its Onshore Bond Market

The opening of China’s onshore bond market (EMB) (PCY) was a gradual process that included a number of cautious measures.

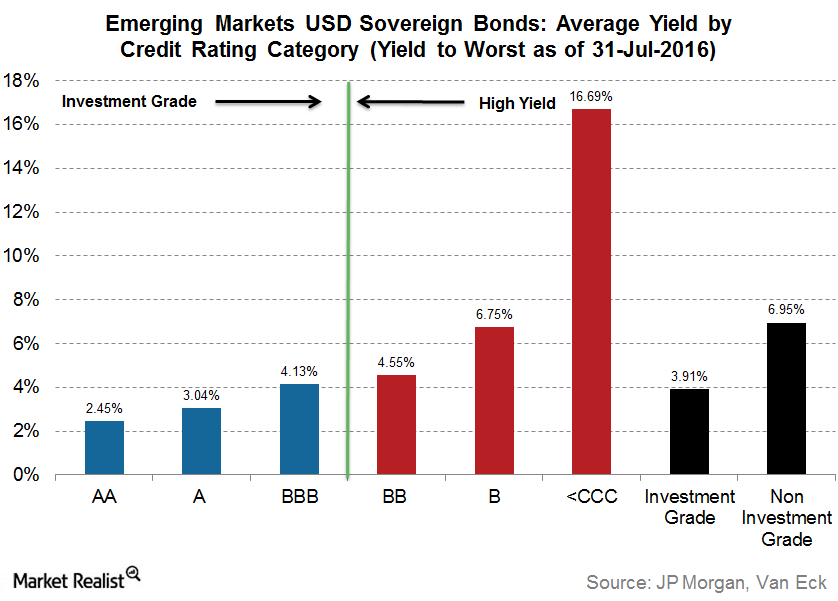

Quality May Provide Attractive Risk-Adjusted Returns

It’s useful to analyze the historical returns of credit rating categories within emerging markets bonds.

Why Should Investors Focus on Real Yield in Emerging Markets?

Real yields in emerging markets (or EM) have remained at compelling levels over the past few years.

Could China Attract Higher Inflows after Bond Market Reforms?

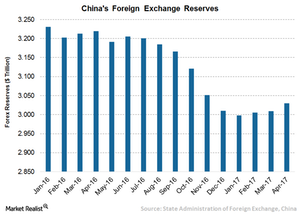

The yuan remains a focus of attention of the international community and a key risk for China’s macroeconomic stability in recent years.

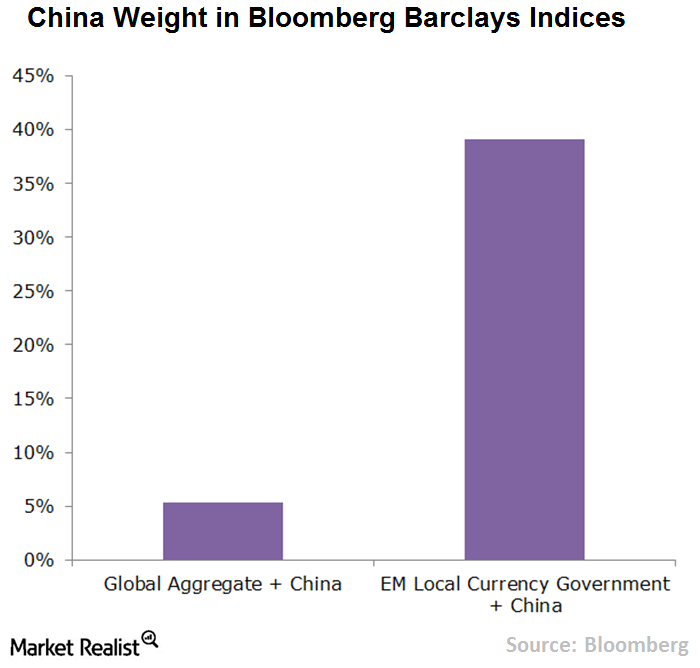

What Difference Does Index Inclusion Make?

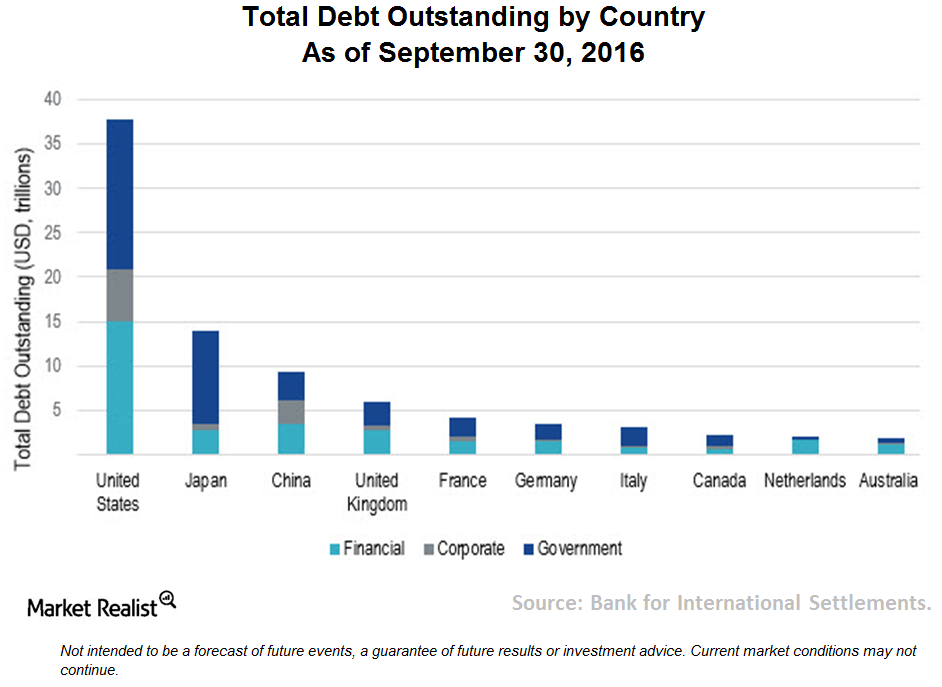

Government bond yields in China are higher than its Asian counterparts such as South Korea and Singapore and much higher than major developed markets.

How Higher Inflows to China Could Impact Other Emerging Markets

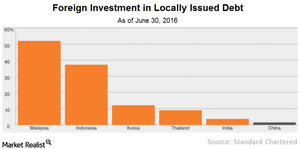

With the onset of reforms, foreign holdings in China’s onshore bond (EMB) (PCY) market is gradually increasing.

What’s Holding Back Foreign Investors from China?

Many leading bond index providers are still not including China’s onshore bonds in their benchmark indexes due to various regulatory and operational concerns.

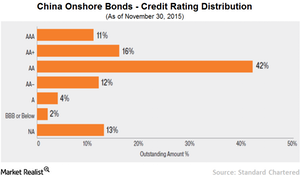

China’s Onshore Bond Market Reforms

China’s onshore bond market (EMB), consisting of locally denominated and issued bonds, is larger than the offshore bond market.

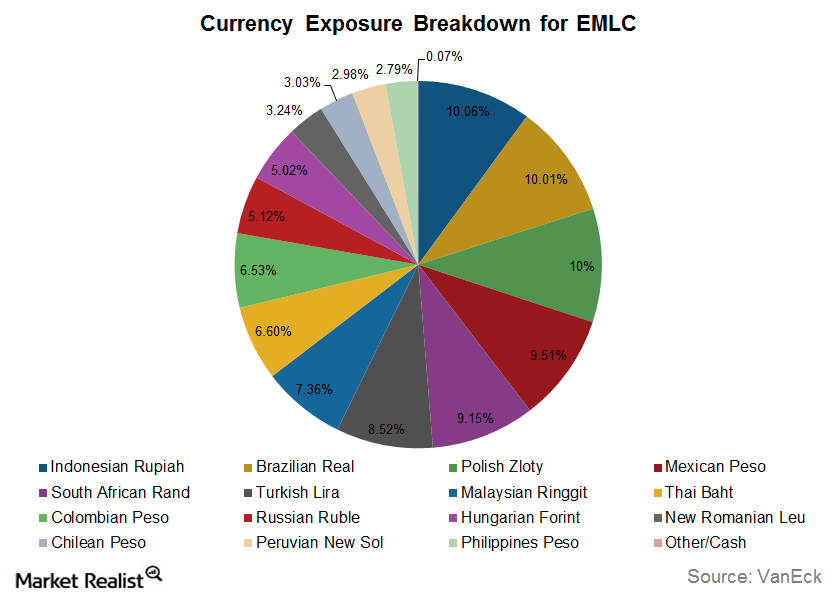

Why Emerging Market Local Currency Bonds Are Looking Attractive

Emerging market economies have bounced back in 2016, delivering strong economic growth with improved fundamentals and better capital management.

Looking to Local-Currency Emerging Market Bonds for Opportunities

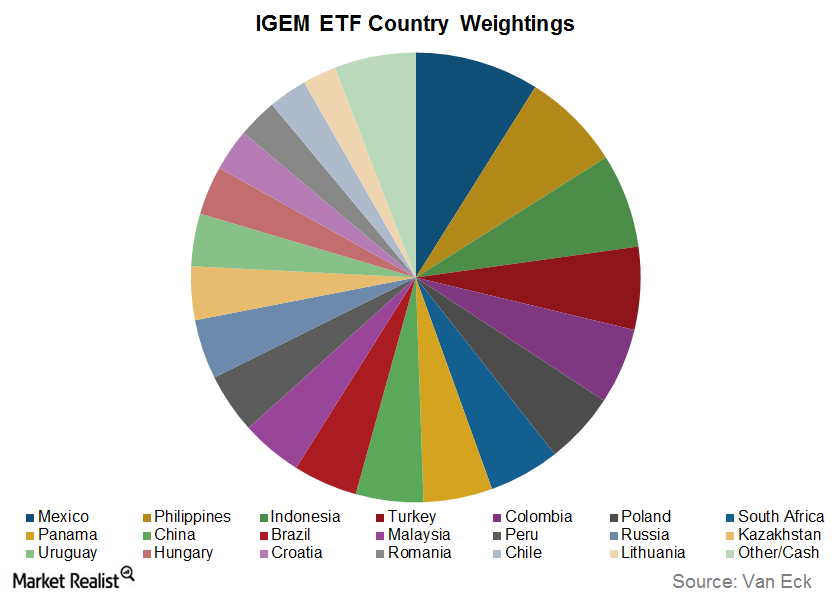

In today’s context, emerging market bonds (IGEM) look like good opportunities for investors.

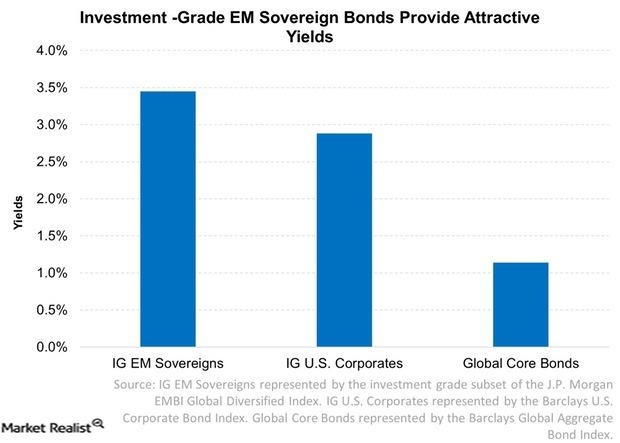

Investment-Grade Emerging Market Bonds Appear Attractive

Investment-grade emerging market sovereigns have been given BBB or higher credit ratings by one of the credit rating companies. They’re relatively safe.

Emerging Market Bonds: Higher Yields Could Reflect Higher Risks

Emerging market bonds have been doing extremely well over the past couple of months. EM debt funds have been in the green for seven consecutive weeks.