Horizon Pharma PLC

Latest Horizon Pharma PLC News and Updates

Introducing Krystexxa, the Latest Addition to Horizon’s Orphan Portfolio

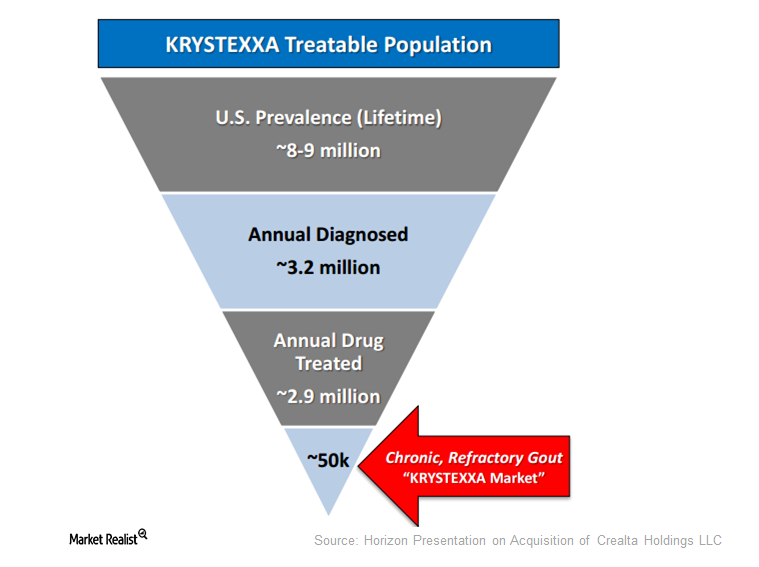

In January 2016, Horizon acquired Krystexxa from Crealta Holdings. The drug has been approved by the FDA for the treatment of chronic refractory gout.

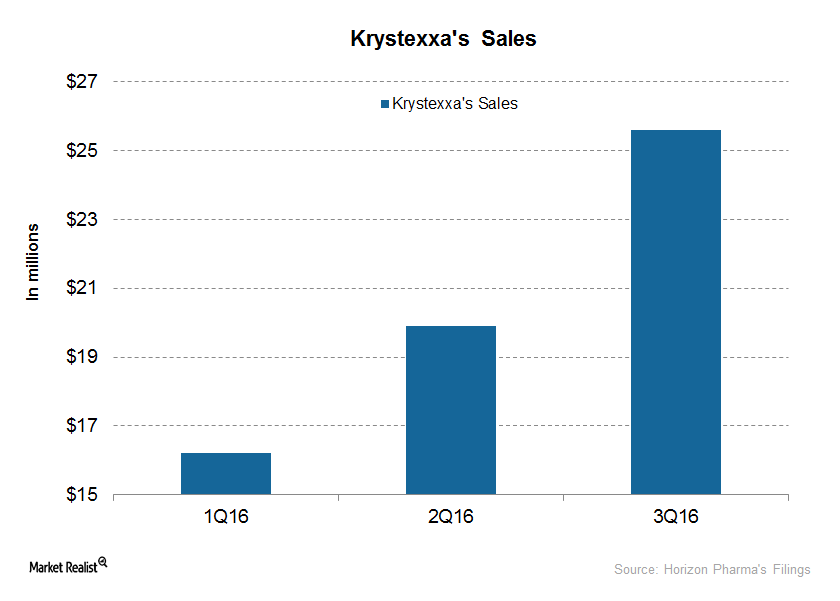

Revenue Drivers for Krystexxa, Horizon’s Orphan Biologic Drug

Horizon plans to drive Krystexxa through increased awareness and outreach, investing in its marketing and medical education as well as commercial infrastructure.

Buy Allows Horizon to Further Expand into Orphan Drug Space

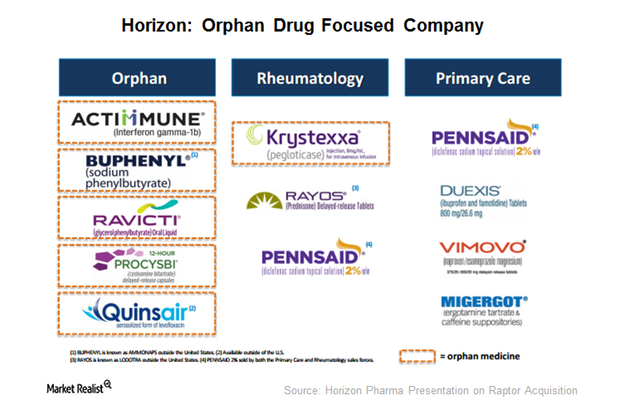

Through the acquisition of Raptor Pharmaceuticals, Horizon Pharma (HZNP) will gain access to Procysbi and Quinsair and expand in the orphan drug space.

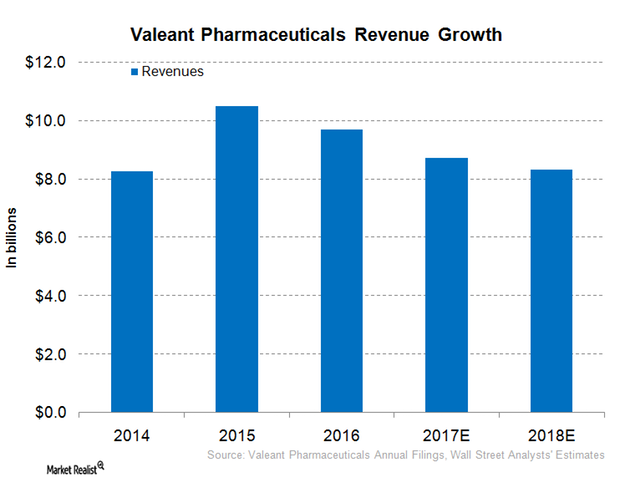

A Deeper Look at Valeant Pharmaceuticals’ Recent Financial Performance

In 3Q16, Valeant Pharmaceuticals (VRX) generated revenues of $2.4 billion, compared with $2.2 billion in 3Q17.

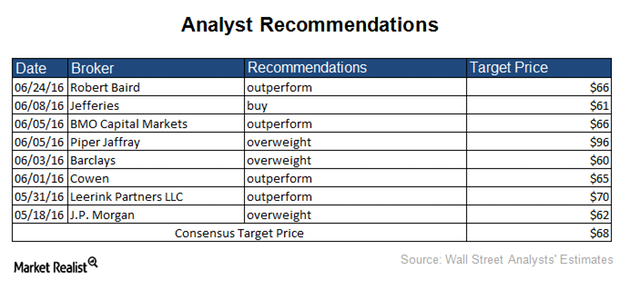

Inside Neurocrine Biosciences’ Analyst Recommendations in 2016

Based on the recommendations of eight brokerage firms, a Bloomberg survey reported that 100% of analysts gave Neurocrine Biosciences “buy” recommendations.

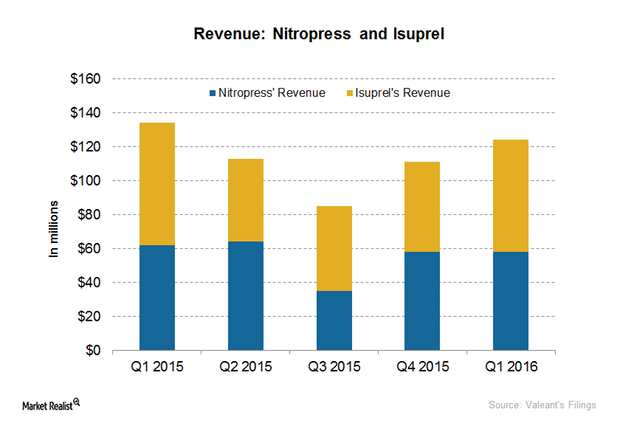

The Facts behind the Valeant Drug Pricing Controversy

Valeant Pharmaceuticals International (VRX) significantly raised the prices of two of its heart drugs—Nitropress and Isuprel—which caused a controversy and an outrage.