First Trust Indxx Global Agriculture ETF

Latest First Trust Indxx Global Agriculture ETF News and Updates

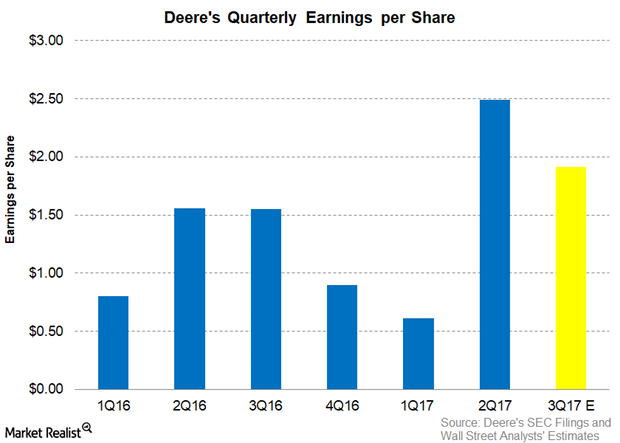

Can Deere Beat the Analysts’ Earnings Estimate Again in Fiscal 3Q17?

Analysts are expecting Deere (DE) to post EPS earnings per share of $1.91 for fiscal 3Q17, which would be an increase of 23.2% on a YoY basis.

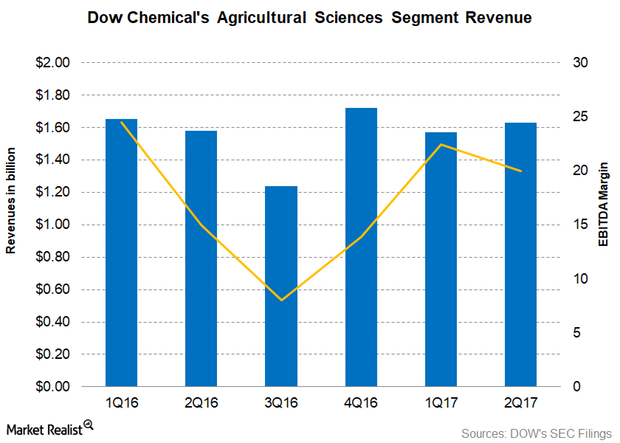

What Boosted DOW’s Agricultural Sciences Segment’s 2Q17 Revenues?

Dow Chemical’s (DOW) Agricultural Sciences segment accounted for 11.8% of DOW’s total revenue as compared to 13.2% in 2Q16.