Fidelity National Information Services Inc

Latest Fidelity National Information Services Inc News and Updates

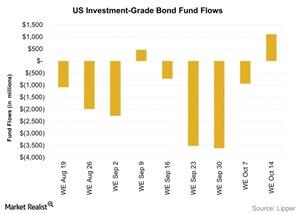

Investment-Grade Bond Funds Witness Inflows

Flows into investment-grade bond funds were positive for the week ending on October 14 after witnessing four consecutive weeks of outflows.

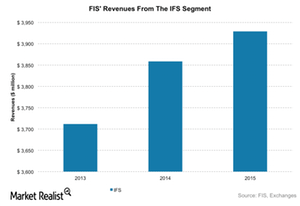

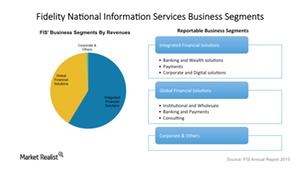

Inside FIS’s Integrated Financial Solutions Segment

FIS’s Integrated Financial Solutions segment caters to North American banks and is the largest contributor to the company’s total revenues (~60%).

Tesla Institutional Investors: Who All Sold Too Early?

In 2019, Tesla (TSLA) rose 29.3%. The S&P 500 Index gained 29.2%. The top institutional investors were bullish on the electric car manufacturer in Q3 2019.

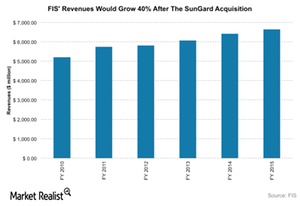

What the SunGard Acquisition Could Bring for FIS

In August 2015, FIS acquired SunGard for $9.1 billion, its largest acquisition to date. SunGard is expected to expand FIS’s top line by nearly 50%.

How Are FIS’s Business Strategies Driving Growth?

FIS plans to build stronger client relationships through multidimensional offerings. Its SunGard acquisition should also help expand client relationships.

Inside FIS’s Operating Model

In 2015, FIS reorganized and began reporting its results under three segments. But after the SunGard acquisition, another restructuring process is underway.

Introducing Fidelity National Information Services

Headquartered in Florida, Fidelity National Information Services is a big hitter in software solutions and innovations in the financial services industry.